The pause in the BOJ’s rate hikes, combined with the slowing its rate cuts, has supported a multi-month rise in the USD/JPY pair. However, changing macroeconomic conditions suggest a potential shift: the Fed may announce cuts while the BOJ could resume hikes, which could reverse the medium-term uptrend.

Markets have largely priced in Japan’s wide-ranging fiscal package, which briefly supported yen sellers. Attention will now focus on the BOJ’s next move, while the Fed is widely expected to deliver a 25 basis point cut.

Bank of Japan Hints at Hawkish Moves

The USD/JPY pair, nearing long-term highs, is likely adding pressure on the BOJ to resume rate hikes, especially since interventions tend to be short-lived. Governor Ueda has signaled that a hike could be considered at the upcoming meeting, a notable shift from previous cautious statements. Markets now assign a 60% chance of a hawkish move this month and 90% in January.

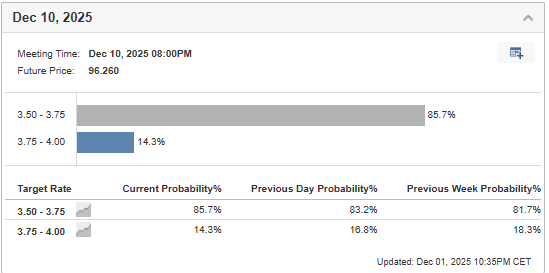

Meanwhile, expectations for a 25 basis point Fed cut before year-end are rising, now at just over 85%, up from 81.7% a week ago.

This setup suggests that USD/JPY sellers could push for a deeper correction. The next key meetings are the Fed on December 10 and the BOJ on December 19.

Bank of Japan Makes Case for Raising Rates

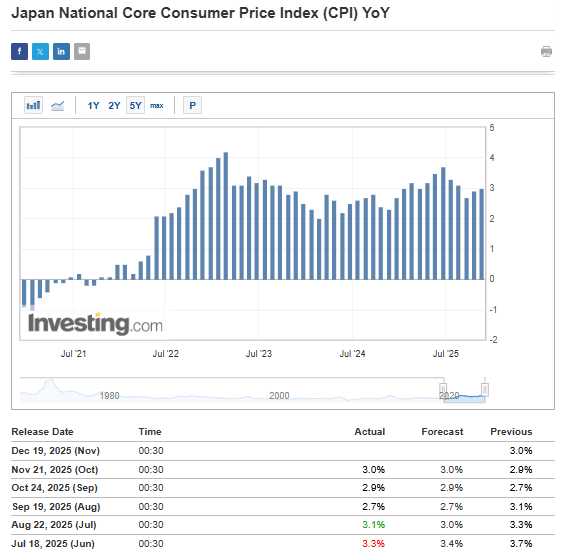

From a macroeconomic perspective, the BOJ has a case for raising interest rates, particularly since has stayed above the 2% target for over three years.

If markets expect a December rate hike that does not materialize, the opposite effect could occur, allowing USD/JPY to continue rising, potentially toward 160 yen per dollar. This upward move could be stronger if the Fed also remains passive, though that scenario is currently considered less likely.

Critical Zone Emerges for USD/JPY Price Correction

USD/JPY hit a local high around 158 yen per dollar just before this year’s January peaks. The current rebound has reached the 155 yen per dollar demand zone, where the short-term direction of the correction is likely to be decided.

If sellers push lower, the next support levels are 153 and 151 yen per dollar. The main resistance remains the recent high of 159 yen per dollar.

***

Below are the key ways an InvestingPro subscription can enhance your stock market investing performance:

- ProPicks AI: AI-managed stock picks every month, with several picks that have already taken off in November and in the long term.

- Warren AI: Investing.com’s AI tool provides real-time market insights, advanced chart analysis, and personalized trading data to help traders make quick, data-driven decisions.

- Fair Value: This feature aggregates 17 institutional-grade valuation models to cut through the noise and show you which stocks are overhyped, undervalued, or fairly priced.

-

1,200+ Financial Metrics at Your Fingertips: From debt ratios and profitability to analyst earnings revisions, you’ll have everything professional investors use to analyze stocks in one clean dashboard.

-

Institutional-Grade News & Market Insights: Stay ahead of market moves with exclusive headlines and data-driven analysis.

-

A Distraction-Free Research Experience: No pop-ups. No clutter. No ads. Just streamlined tools built for smart decision-making.

Not a Pro member yet?

Already an InvestingPro user? Then jump straight to the list of picks here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.