Tesla (NASDAQ:) shares dropped 3.55% on Wednesday, followed by a 5.23% pre-market decline at the time of writing. Since hitting a high of $367.71 on May 29, the stock has fallen more than 11%.

That is a sharp turnaround from the 23% gain it saw last month after CEO Elon Musk said he was leaving President Trump’s Government Efficiency group.

Now, investors are wondering: Is this dip a chance to buy in, or the beginning of a bigger slide?

Tesla Welcomes Elon Musk Back After His DOGE Detour

One reason Tesla shares performed well last month was Elon Musk’s decision to step back from President Trump’s DOGE initiative. During the company’s Q1 earnings call, Musk said he would be spending “a lot more time on Tesla” starting in May.

He made good on that promise last week by officially resigning from the agency, which gave the stock another lift.

Musk’s bold leadership has been a major reason behind Tesla’s stock popularity. But his growing involvement in other ventures had started to frustrate investors and raise concerns among analysts.

Now, Tesla needs his focus more than ever. Sales dropped 20% year-on-year in Q1, and the company is trying to turn things around.

Investors are betting that upcoming plans, like launching cheaper models and the Robotaxi project, can drive growth. If successful, the Robotaxi service could grow fast, since many Teslas already on the road could be used in the network.

That would also open up a new revenue stream, as Tesla owners could let their cars join the fleet and earn money.

Is Now the Right Time to Buy Tesla Shares?

However, there is no clear sign that these positive developments have not already been priced into the stock.

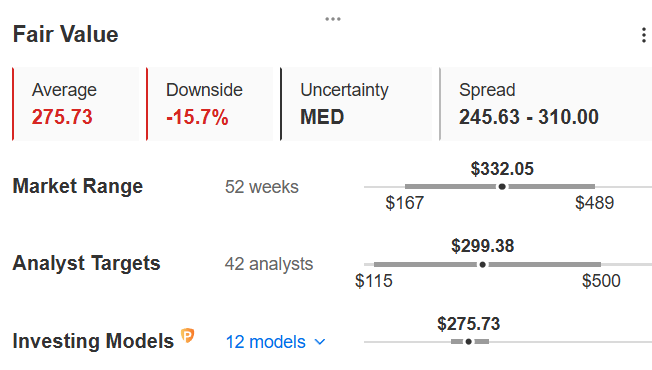

In fact, most analysts remain neutral on Tesla. Their average price target is $299.38 — nearly 10% lower than where the stock closed last night.

Source : InvestingPro

Valuation models also suggest that Tesla’s stock price is above its fundamental worth. According to InvestingPro’s Fair Value, which combines several valuation methods, Tesla should be worth around $275.73 — about 17% lower than where it closed yesterday.

This suggests that the recent drop in Tesla’s stock might continue, potentially creating a better buying opportunity later in the year when new product launches could have a bigger impact.

Given this, investors seeking strong growth in tech may want to consider other, lesser-known stocks instead of Tesla.

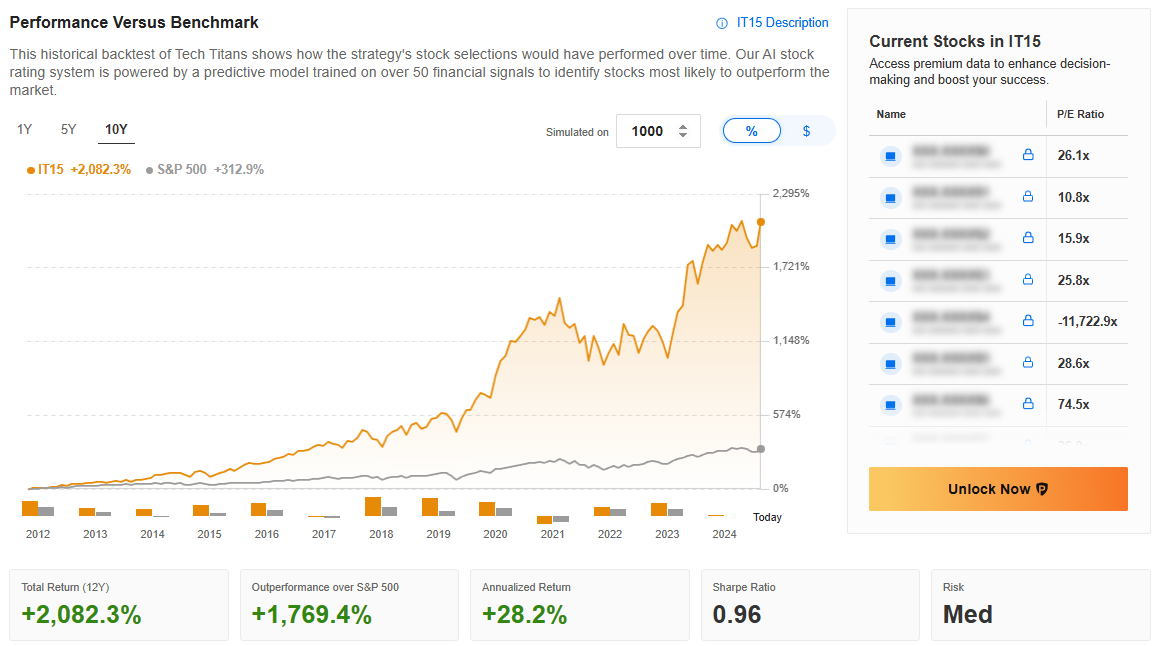

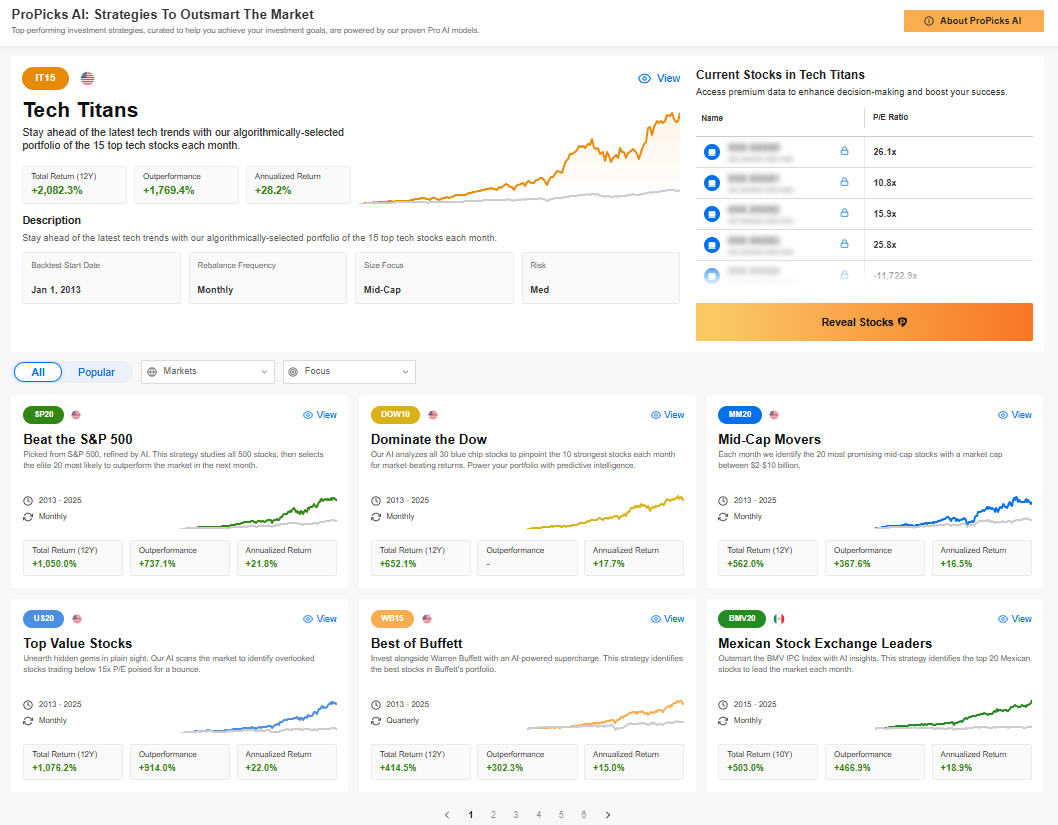

InvestingPro’s “Titans of Tech” strategy, for example, shares a monthly list of 15 under-the-radar tech stocks that show strong potential before they gain wider attention.

This strategy delivered strong results in May, with 11 of its stock picks gaining more than 10% in a month, and three rising over 20%.

Some of the names picked for June are already off to a strong start, too.

This is not a one-off. The strategy has a track record of beating the market, and its past performance backs that up. You can find more details about it here.

The Tech Titans strategy is just one of over 30 AI-managed strategies available, covering both thematic and regional focuses. This makes it easier for investors with different goals and risk appetites to find a strategy that fits their needs.

Subscribe here to unlock access to InvestingPro’s AI strategies and AI-selected stock winners.

****

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.