- Nvidia reported strong quarterly results, with the stock gaining 5% after-hours.

- Data centers led revenue growth while the gaming segment was up 42% year-on-year.

- Export restrictions in China caused $2.5 billion write-offs; risks remain.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

NVIDIA Corporation (NASDAQ:) is usually the last of the big tech companies to report its quarterly results, and it followed that pattern again this time. The released after yesterday’s session were positive, as shown by the stock’s 5% gain in after-hours trading.

Along with the results, Nvidia’s management also shared very optimistic comments, similar to last quarter. CEO Jensen Huang highlighted that their latest product, the Blackwell NVL72, puts Nvidia at the center of the global AI boom. He believes this trend will speed up even more, driving stronger demand.

Despite some challenges with exports to China, this sets up a strong case for the stock to keep rising.

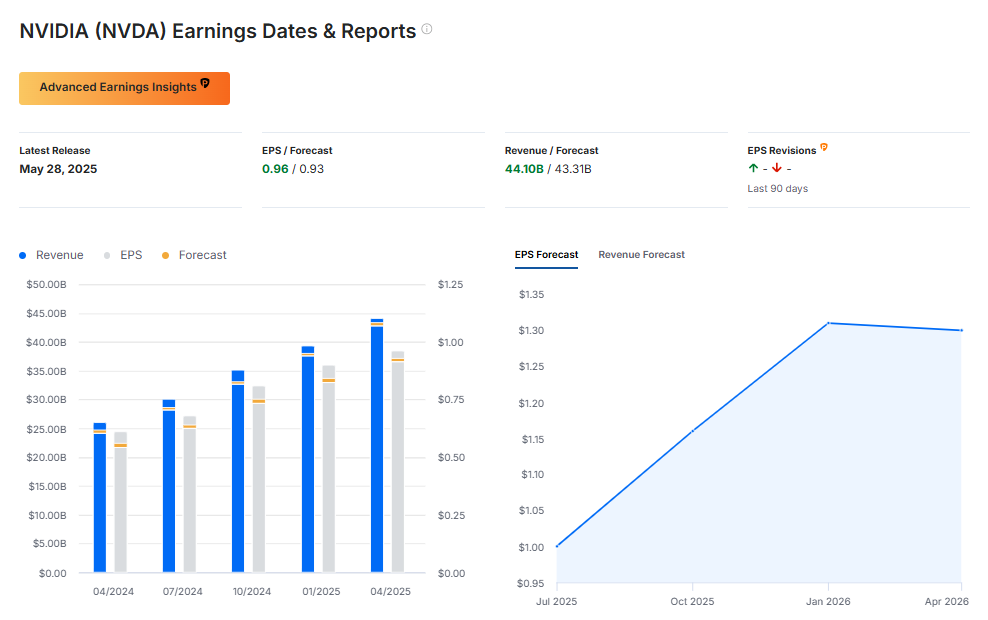

Nvidia Extends Earnings Beat Streak

Here are the key financial results for Nvidia’s first quarter of fiscal year 2026:

Nvidia has now grown both its revenue and earnings per share every quarter for over two years, consistently beating market expectations — including this quarter.

Looking closer at the numbers, data centers remain the company’s top revenue driver, bringing in $39.1 billion, a 10% increase from last year. The gaming segment also showed strong momentum. While it generated a much smaller $3.8 billion in revenue, that figure was up 42% year-on-year, a positive sign for future growth.

On the strategic front, Nvidia announced plans to build factories in the US with its partners. These will form the core infrastructure for producing supercomputers powered by Nvidia’s top products. The company also said similar investments are planned in Saudi Arabia and the United Arab Emirates.

China Export Restrictions Weigh on Outlook

Alongside the positive news, there are also some challenges that weigh on Nvidia’s overall outlook. The biggest issue is the ongoing restrictions on selling advanced technology to China, one of Nvidia’s key markets. Last month, it was confirmed that selling H20 chips to China now requires special licenses. As a result, Nvidia had to write off $2.5 billion in unrealized sales.

Looking ahead, losses are expected to increase. In the next quarter, the company may have to write down as much as $8 billion for similar reasons. Despite these headwinds, Nvidia has forecast revenue of around $45 billion for the upcoming quarter, with a margin of error of 2%.

Nvidia Stock Technical Outlook

In after-hours trading, Nvidia’s stock is hovering around $141 per share, a level where there is strong selling pressure. If the stock can break through this zone—which appears likely—it could move toward its all-time high near $152 per share.

If Nvidia’s steep uptrend line is broken, it may not signal a full reversal of the long-term upward trend. However, it could lead to a pullback toward the support level around $122 per share.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.