Since mid-2022, Netflix (NASDAQ:) stock has been on a steady upward path, with periodic pullbacks. The strongest gains have come around earnings season, as the company consistently beats Wall Street’s expectations for revenue and net income.

With Netflix no longer reporting subscriber numbers, investors have shifted their attention to other key metrics—such as margins, net income, and revenue from both subscriptions and advertising.

Much of Netflix’s recent success can be traced back to two major moves in 2022: introducing a lower-cost ad-supported tier and cracking down on password sharing. These decisions helped reignite growth, leading to six consecutive quarters of double-digit revenue increases.

Since the first of those reports in January 2024, Netflix shares have surged 129%, far outpacing the 28% gain. The key question now is whether Netflix can extend that momentum with another strong Q2 performance.

Netflix’s Core Strengths Behind Its Global Success

Netflix posted a record net profit of $2.89 billion —its highest ever. This strong result reflects its global subscriber base, which can choose from various plans ranging from $7.99 to $24.99.

Advertising is becoming a major part of Netflix’s business, with 94 million users now on ad-supported plans. To strengthen this area, Netflix has launched its own ad tech platform. With a projected $8 billion in free cash flow for 2025, the company has the financial backing to continue investing in this platform.

Netflix aims to double its ad revenue this year to $3 billion. However, one possible challenge is the impact of President Donald Trump’s proposed tariffs. If applied to the film industry, these tariffs could raise the cost of producing content outside the US.

High Optimism Ahead of Netflix’s Results

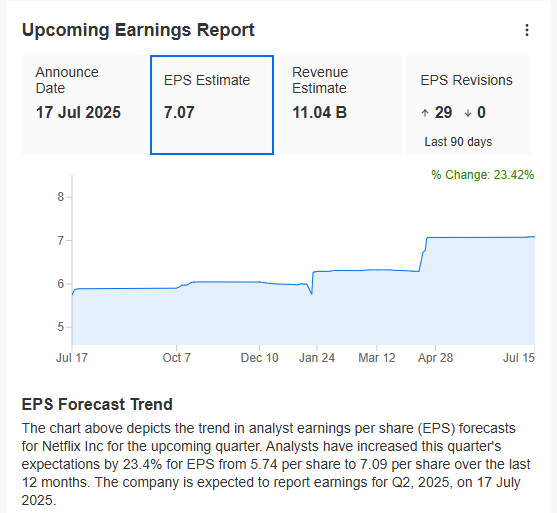

Over the past three quarters, investors have responded very positively to Netflix’s financial results, showing strong confidence in the company right after each earnings release.

Market sentiment around Netflix remains highly optimistic, with many analysts raising their estimates and no downward revisions in sight. If the company meets expectations, both its revenue and earnings per share will hit new all-time highs.

Is Netflix’s Correction a Buy Signal for the Next Leg Up?

After hitting new all-time highs, Netflix’s stock is now going through a correction and is approaching a key support level around $1,230 per share.

It is likely that Netflix’s stock will stay around the current support level during today’s session. The next move will depend on the quarterly results set to be released afterward. If the results are strong, the stock could resume its uptrend and reach new all-time highs. However, if the support level is broken, the correction could deepen and take the price below $1,200 per share.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services.