6){ atwWrapper.find(‘.js-slider-next’).fadeIn(600); } } function atwMoveRight() { atwWrapper.find(‘.js-slider-prev’).fadeIn(150); $(“.slider > :visible:first”).hide(150) $(“.slider > :visible:last”).next().show(150); if(!$(“.slider > :visible:last”).next().find(‘.name’).html()){ atwWrapper.find(‘.js-slider-next’).fadeOut(150); return; } } function atwMoveLeft() { atwWrapper.find(‘.js-slider-next’).fadeIn(150); $(“.slider > :visible:last”).hide(150); $(“.slider > :visible:first”).prev().show(150); if(!$(“.slider > :visible:first”).prev().find(‘.name’).html()){ atwWrapper.find(‘.js-slider-prev’).fadeOut(150); return; } } initATWSlider(); //update star icon on adding/removing instrument to/from specific watchlist atwWrapper.on(‘click’, ‘label.addRow’, function() { let parent = $(this).parent(); let checkedPortfolio = false; parent.find(‘input[type=checkbox]’).each(function () { if($(this).is(‘:checked’)){ checkedPortfolio = true; } }); let closestStar = $(this).closest(‘.addToPortWrapper’).find(‘.star’); if(checkedPortfolio){ closestStar.addClass(‘added’); }else{ closestStar.removeClass(‘added’); } }); //update star icon on creating new watchlist atwWrapper.find(‘.js-create-watchlist-portfolio’).find(‘a.js-create’).on(‘click’,function () { let parent = $(this).parent(); let watchlistName = parent.find(‘input[type=text]’).val(); if(!watchlistName){ return; } let star = $(this).closest(‘.addToPortWrapper’).find(‘.star’); star.addClass(‘added’); }); //update star icon on adding new position atwWrapper.find(‘.js-create-holdings-portfolio’).find(‘.js-submit’).on(‘click’,function () { let addPositionForm = $(this).closest(‘.addToPortfolioPop’).find(‘.holdingsContent’); let amount = addPositionForm.find(‘.js-amount’).val(); if(amount

What happens when a market really wants to decline, but it gets no trigger?

It’s waiting for the trigger, and waiting… And finally moves anyway, even in its absence.

That’s what we see in gold and silver today. To be precise, what we now see is much more bearish than just that. Gold is declining not just in the absence of a rally in the . Gold and silver are declining (and gold is moving to new May lows as well as below its early-April high) despite the USD’s small decline.

This is a bearish confirmation that’s as clear as it gets.

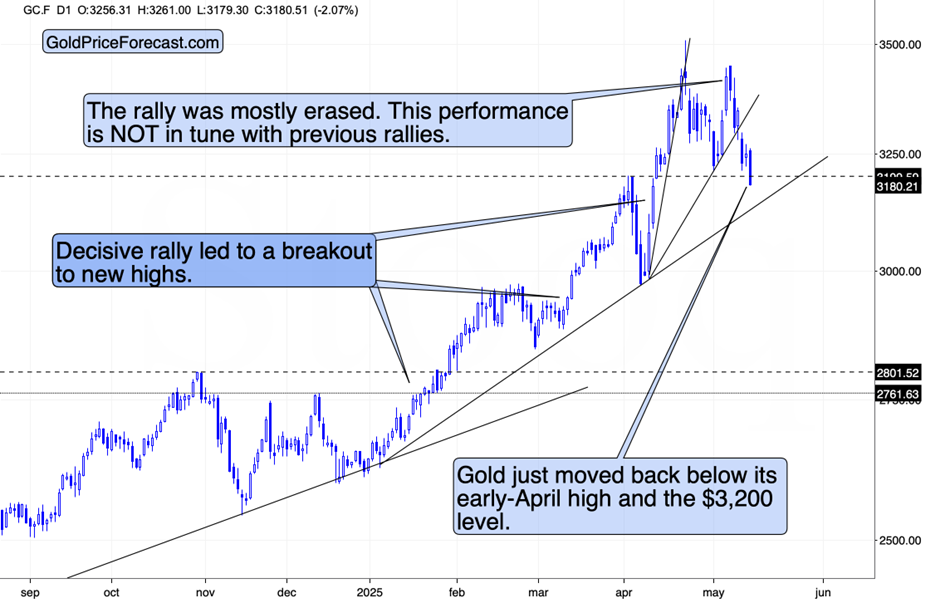

Gold Futures (GC=F), Daily Chart

Gold Futures (GC=F), Daily Chart

previously (in late February and early April) reversed after moving to its previous highs and then continued to climb. This time it’s doing something else and it’s doing it despite the dollar’s small decline. This is a huge red flag for anyone still being short-term bullish on gold.

Gold had a very good reason to hold above that early-April high. It didn’t. And this happened right after silver showed immediate-term strength and miners lagged, which means that it all “fits”. Quoting my yesterday’s comments:

The way gold and silver are performing today seems to indicate that we’ll get more weakness soon. The reason is that while gold corrected yesterday’s decline in a way that’s not that meaningful, silver rallied quite visibly.

Remember – silver’s very short-term outperformance is a sign of an upcoming weakness in both metals (and likely in other markets).

Silver Slips Again

That’s exactly what happened.

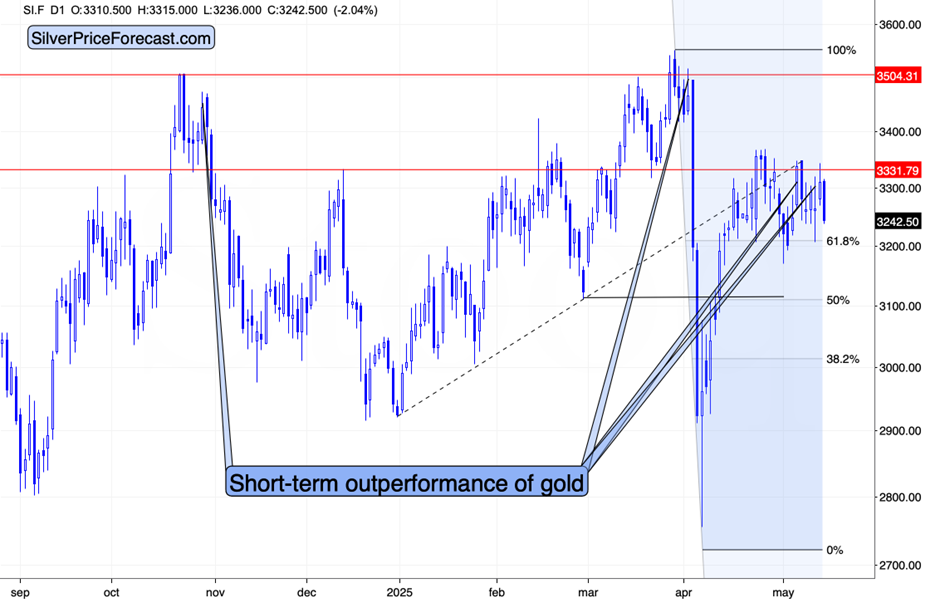

Silver Futures (SI=F), Daily Chart

Silver Futures (SI=F), Daily Chart

is also moving lower, although its decline is still within the recent trading range.

That’s just how silver is – it doesn’t do much… Until it does. And then it’s too late to enter trades or adjust positions as things are so happening so quickly that before you know it, the targets are reached. Remember the early-April slide?

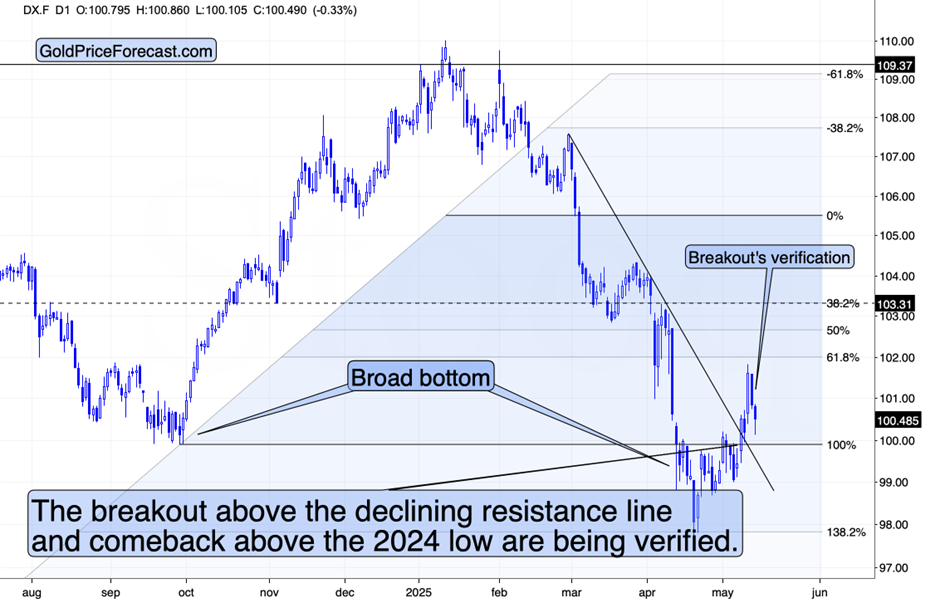

The USD Index did move lower today, but it has done so in a completely normal fashion. The breakout and the rally were significant, and a pullback is to be expected at this stage. This simply prepares the market for another leap higher.

The fact that gold and silver declined before that rally and during the rebound is really profound, but I already wrote about it twice (this is so important that emphasizing it for the third time still makes sense, though).

Stocks are pretty much flat today. This could be the day they confirm their breakout above the previous high, or the day when they invalidate it. Many signs point to the invalidation, but we’ll just have to wait and see. Paul sees this as a consolidation, and while I respect his opinion (he has profitable positions in S&P and JPM – the former based on his Volatility Breakout System) let’s keep in mind that consolidations can end in both directions.

I continue to think that the next big move in stocks is to the downside. The tariffs are either higher than they were before April or they are just delayed. Even after the recent temporary decrease in tariffs in the case of the U.S. and China, the tariffs are still higher than they were before April. So, the overall impact on world trade is still negative, and it can be more negative depending on what happens when the 90-day pause ends.

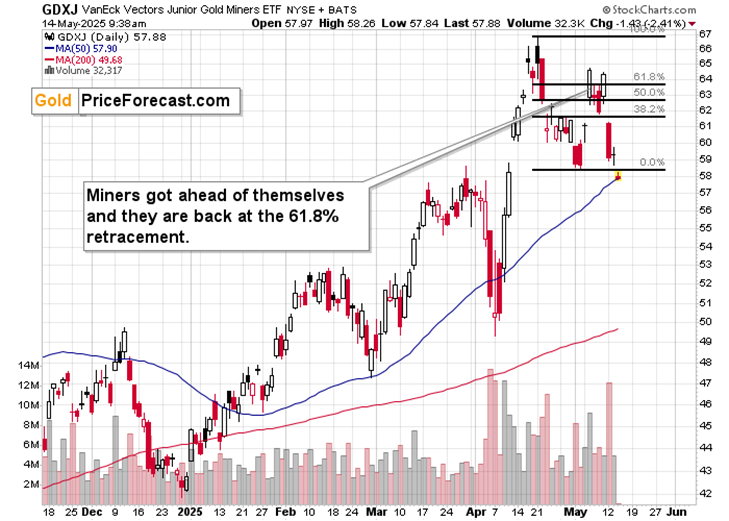

VanEck Vectors Junior Gold Miners ETF (GDXJ), Daily Chart

VanEck Vectors Junior Gold Miners ETF (GDXJ), Daily Chart

Just as gold is back below its April high, the VanEck Junior Gold Miners ETF (NYSE:) is back below its March high.

Given that stocks haven’t declined yet, and that the USD Index is not higher, but lower today, the above is really significant. This tells us that the GDXJ is most likely on a verge of a much bigger decline.

Major Decline May Be Imminent

This fits the downside target scenario – that I outlined in yesterday’s Gold Trading Alert – very well. In fact, it seems that given the way GDXJ is performing today, the nearest downside target can be reached shortly.

We have a sizable line-up for tomorrow: , , , and Powell will speak. The stock market might be waiting for all those details before moving. And when the stock market moves, many other markets will likely follow.