- Oil prices rose 5% on hopes of a US-China trade deal boosting demand.

- Tensions with Iran and weak nuclear talks raise the risk of regional conflict and price spikes.

- OPEC+ supply shortfalls and falling US inventories point to a possible crude shortage.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

prices jumped by as much as 5% yesterday, bringing WTI crude close to $70 per barrel. The main reason for the rise is positive news about a possible trade deal between China and the US, though no final agreement has been reached yet.

At the same time, talks with Iran over its nuclear program have not made much progress. If the negotiations fail completely, there is a risk of military conflict, which often pushes oil prices higher.

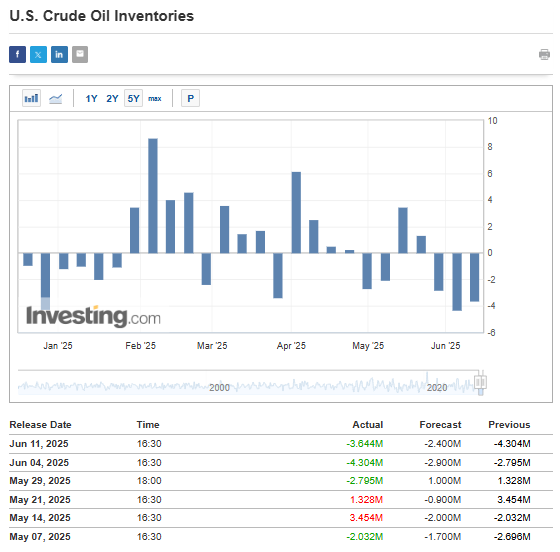

Adding to the upward pressure, US oil inventories fell more than expected for the third month in a row.

Oil Prices Move Under Geopolitical Pressure

Looking at the different parts of the ongoing tariff war, the situation with China seems to have the biggest impact on financial markets, including oil. The latest statement says that the deal is almost complete, but both Donald Trump and Xi Jinping still need to sign it. Given how quickly things can change, nothing is certain yet.

Still, the market is already hoping for a return to normal trade, especially for semiconductors and rare earth metals, which appear to be the key negotiating points for both countries. A revival in trade and a stable long-term deal would help GDP growth, which would also increase demand for oil.

Yesterday’s decision to withdraw some staff from the US embassy in Baghdad is a bad sign for the US-Iran talks on stopping Iran’s nuclear program in exchange for easing Western sanctions. People involved in the talks say that Iran is demanding more, and although negotiations are still ongoing, the chances of a deal look slim.

In the worst case, the US could launch strikes on Iran’s nuclear sites. If that happens, Iran may retaliate, and the conflict could spread across the region, pushing oil prices much higher.

Last month, OPEC+ announced a production increase of 310,000 barrels per day but managed to raise output by only 180,000 barrels. Key producers, led by Saudi Arabia, were unable to boost production as planned.

Combined with falling US oil inventories, this points to a possible, at least short-term, shortage of crude on the global market, especially if trade activity and GDP growth in the US pick up.

WTI Crude Oil Prices Approach Key Supply Zone

WTI crude oil has broken through the resistance level around $65 per barrel, opening the way for further gains. The next target for buyers is the supply zone near $72 per barrel, which is where a strong downward move started in early April.

Any possible pullbacks are likely to face support near the intersection of the rising trend line and the previously broken resistance, which now acts as support. In a very bullish scenario, if prices break above $72 per barrel, they could even move toward this year’s highs just below $80 per barrel.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.