Bitcoin hit a record high yesterday, rising as high as $124,447, accompanied by the positive mood that continued throughout the week. However, we saw a rapid retreat after sharp profit-taking at the record level.

This week’s mild US data strengthened market expectations that the Fed will begin the rate reduction process. In addition, the US President’s support for the new decree allowing investment in crypto assets through 401(k) retirement plans acted as an additional catalyst. In light of these developments, Bitcoin continued its upward trend in the first half of the week, reaching a new peak.

However, profit-taking came into play later in the day. Then, the higher-than-expected data from the US helped turn the tide. The unexpected rise in producer prices raised concerns and weakened expectations of a Fed rate cut. This showed us once again that Bitcoin remains heavily Fed-driven.

Bessent’s Statements Further Depressed the Market

Another factor that accelerated the decline was US Treasury Secretary Scott Bessent’s statement that “The Treasury has no Bitcoin purchase plan.” After this statement, Bitcoin lost $55 billion in market value in about 40 minutes. As reactions intensified, Bessent backtracked on the same day, stating that the purchase of Bitcoin through budget-neutral means was still under consideration.

The Strategic Bitcoin Reserve plan, initiated by a presidential decree signed in March, has still not taken any concrete steps. According to the latest data, the US Treasury holds 198,012 BTC, worth about $23.5 billion.

Although this week’s developments have increased short-term volatility in Bitcoin, the cryptocurrency maintains its upward trend.

Bitcoin Technical Outlook

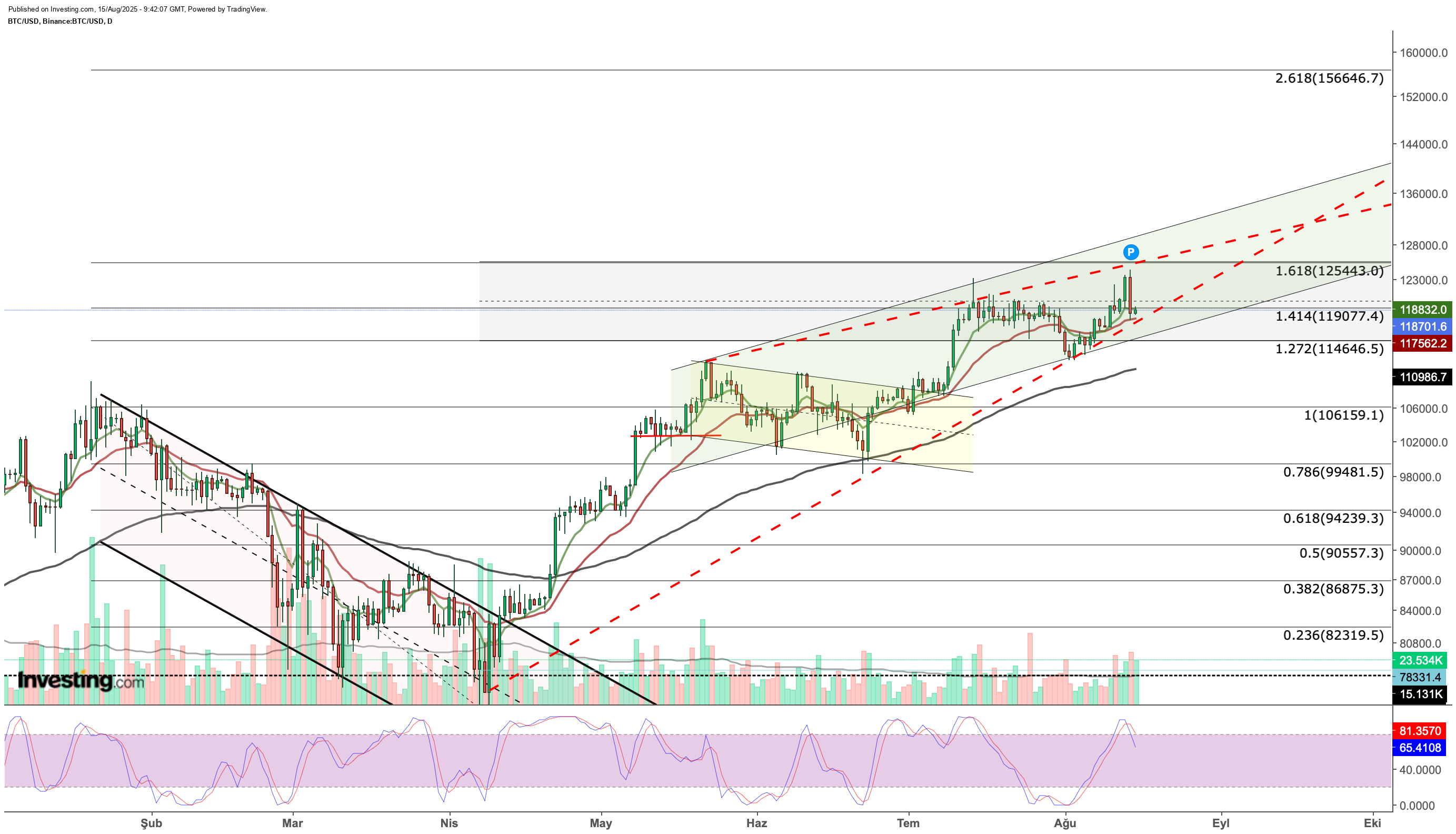

After peaking at $124,400 this week, Bitcoin lost nearly 5% of its value and found support around $117,800. Today, the cryptocurrency rose slightly toward $119,000 and closed the price gap at $118,335 in CME futures.

Bitcoin, which continues to remain within the ascending channel, has nearby support and resistance levels according to Fibonacci levels and trend lines. As of now, $119,000 (Fib 1.414) is the pivot level for Bitcoin, which is moving in line with the Fibonacci levels we track based on the decline in the first quarter of the year. Just below this level, $117,500 is being monitored as intermediate support based on the rising trend and short-term EMA values. Breaking this support may cause a dip down to $114,600. If selling pressure continues, the 3-month EMA value at $11,980 could be tested. With weekly closes below this level, a new downward trend may begin to gain momentum.

Bitcoin, which continues to remain within the ascending channel, has nearby support and resistance levels according to Fibonacci levels and trend lines. As of now, $119,000 (Fib 1.414) is the pivot level for Bitcoin, which is moving in line with the Fibonacci levels we track based on the decline in the first quarter of the year. Just below this level, $117,500 is being monitored as intermediate support based on the rising trend and short-term EMA values. Breaking this support may cause a dip down to $114,600. If selling pressure continues, the 3-month EMA value at $11,980 could be tested. With weekly closes below this level, a new downward trend may begin to gain momentum.

On the other hand, if Bitcoin manages to stay above $117,500 with daily closes, we could see an attempt toward $125,440, which we follow with Fib 1.618. A possible breakout could continue with new highs at $130,000 along the upper boundary of the rising channel. This would support forecasts of $156,000 toward the end of the year.

At this point, the main trigger will be the initiation of the interest rate cut process. Incoming macro data supporting this decision ahead of September may play a leading role in driving further upward moves. In addition, low geopolitical tensions for the remainder of the year will support Bitcoin’s positive outlook. Therefore, the outcome of the meeting between Trump and Putin, who will meet in Alaska today, may also cause significant volatility in risk markets.

***

Be sure to check out all the market-beating features InvestingPro offers.

InvestingPro members can unlock a powerful suite of tools designed to support smarter, faster investing decisions, like the following:

Built on 25+ years of financial data, ProPicks AI uses a machine-learning model to spot high-potential stocks using every industry-recognized metric known to the big funds and professional investors. Updated monthly, each pick includes a clear rationale.

The InvestingPro Fair Value model gives you a clear, data-backed answer. By combining insights from up to 15 industry-recognized valuation models, it delivers a professional-grade estimate of what any stock is truly worth.

WarrenAI is our generative AI trained specifically for the financial markets. As a Pro user, you get 500 prompts each month. Free users get 10 prompts.

The Financial Health Score is a single, data-driven number that reflects a company’s overall financial strength.

- Market’s Top Stock Screener

The advanced stock screener features 167 customized metrics to find precisely what you’re looking for, plus pre-defined screens like Dividend Champions and Blue-Chip Bargains.

Each of these tools is designed to save you time and improve your investing edge.

Not a Pro member yet? Check out our plans here or by clicking on the banner below. InvestingPro is currently available at up to 50% off amid the limited-time summer sale. Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.