- US Dollar’s drop below 99 reflects broken yield correlation and deepening concerns about fiscal stability.

- Delayed EU tariff decision boosts euro as Trump’s erratic trade stance keeps markets uneasy.

- Core PCE, Fed minutes, and growth data this week could shape short-term dollar sentiment shifts.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

Global markets began the week with little hope that trade tensions between the US and the European Union would ease. On Friday, President Donald Trump said he would place a 50% tariff on the EU starting June 1, which worried investors. But over the weekend, it was announced that this decision would be delayed until July 9. This delay, shared after a meeting with EU Commission President Ursula von der Leyen, gave some hope that trade talks might improve.

The gained some strength from this news, while the dropped below 99, its lowest level in a month, before making a slight recovery.

Is the Confidence Problem Becoming Structural?

The weakness in the US dollar is not just due to trade tensions. In recent weeks, doubts about the strength of the US economy have grown. Moody’s downgrade of the US credit rating has increased worries about whether the country can manage its finances well.

A big reason for this concern is President Donald Trump’s new tax cut and spending plan, which he sent to the Senate. Many expect it will lead to a much larger budget deficit. This makes global investors question whether the US is being financially responsible.

Uncertainty around Trump’s trade policies is adding to these fears. Along with the tariff threat against the EU, proposals like a 25% tax on iPhones—which are made outside the US—worry investors. These kinds of moves could disrupt the global supply chain, especially in tech, and raise overall risk in the markets.

Why Rate Hike Doesn’t Support Dollar

Normally, rising US bond yields help support the dollar. But last week, even though the yield hit an 18-month high of 5.16%, the (DXY) kept falling. This suggests that the usual relationship between bond yields and the dollar is breaking down.

The fact that the dollar is weakening while yields are rising is causing concern. It may point to deeper problems, especially in the bond market. If this continues, global investors may lose interest in US assets.

This week’s economic data from the US could offer important clues about where the dollar is headed. In particular, the will be closely watching the , which is a key measure of inflation.

If the PCE figure comes in lower than expected, it may calm markets by suggesting that the Fed could take a softer stance on interest rate cuts. But if inflation is high, it could increase market concerns about the US, especially after the credit rating downgrade.

This week, markets will also watch key US data, including the first-quarter growth revision, durable goods orders, and consumer confidence from the Conference Board. In addition, speeches by Fed officials and the minutes from the last Fed meeting will play an important role in shaping market direction.

However, US markets are closed today due to a holiday. This could lead to low trading volumes at the start of the week, which may increase price swings and market volatility.

Geopolitical Risks on the Rise Again

Alongside economic concerns, geopolitical risks are also rising again. Hopes for peace in the Russia-Ukraine war have faded, replaced by reports of new military build-ups and weapons being sent to Europe. The US is increasing pressure on Europe, which is helping the euro in the EUR/USD pair while putting downward pressure on the dollar. These developments could also shift how investors look for safe-haven assets.

In the short term, the dollar is under pressure from both trade policy uncertainty and weakening confidence in US economic management. President Trump’s aggressive and unpredictable tone has become a source of ongoing market uncertainty.

Still, it would be premature to rule out a rebound in the dollar over the medium term. There are two key reasons: First, Trump may be pushed to act more cautiously due to political pressure at home. Second, global investors still lack a clear alternative to the US when it comes to market depth and liquidity.

So, the current weakness in the dollar may be temporary. But for any recovery to last, the US will need consistent economic data and more stable political messaging to rebuild trust among investors.

US Dollar Technical Outlook

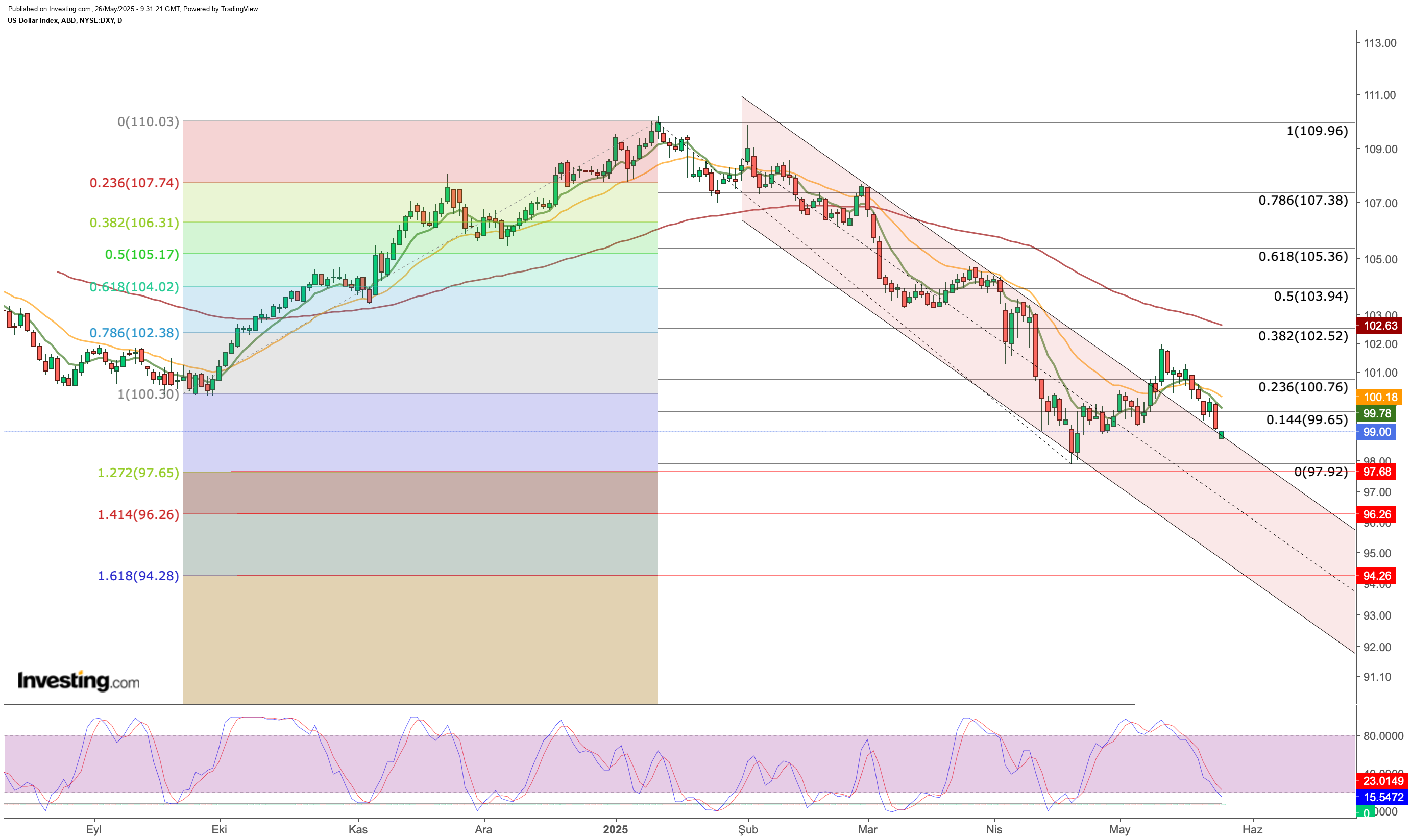

Although the DXY rose to 102 earlier this month, it has turned lower again due to recent developments and is now heading back into the downward trend it has followed since the start of the year.

The index has lost support around 99.65, and as long as it stays below this level, the decline could continue toward the 97.7–97.9 range. If that support does not hold, the DXY could fall further, possibly reaching 96 and then 94 over the medium term.

This week’s core PCE data will likely play a key role. If the figure is lower than expected, it could push the dollar down further and strengthen expectations that the Fed may ease its tight monetary stance. On the other hand, a higher reading could lift the index back above 100, as markets may start pricing in a more hawkish Fed. In that case, the DXY may move in closer step with rising US bond yields.

President Trump’s comments and actions also continue to weigh heavily on the dollar. A softer tone on tariffs in the coming days could calm markets and increase risk appetite, which may reduce demand for the dollar.

However, if Trump maintains a tough stance on trade, market tension could rise again. While this may initially boost dollar demand as a safe haven, ongoing concerns about the US’s long-term fiscal health may limit any lasting recovery in the currency.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.