US Dollar: Downside Risks Rise Amid Downbeat Economic Data Ahead of PCE This Week

US Dollar’s drop below 99 reflects broken yield correlation and deepening concerns about fiscal stability. Delayed EU tariff decision boosts euro as Trump’s erratic trade stance keeps markets uneasy. Core…

USD/JPY Hovers at Make-or-Break Demand Zone With BoJ Hike Odds on the Rise

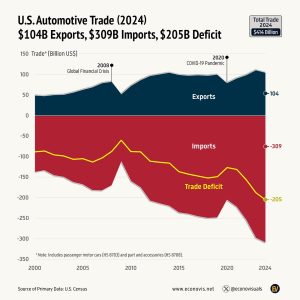

Japan’s inflation and global trade tensions heavily influence the Bank of Japan’s policy decisions. US-Japan trade talks stall over automotive sector; Japan sets aside $6.3 billion for protection. USD/JPY fell…

Ethereum: Retail Still Absent, but Rally Is Gaining Strength

Ethereum’s rally is gaining strength—but retail investors are still watching from the sidelines. With institutions piling in and TVL surging, the next breakout may just be warming up. All eyes…

Gold Eyes Breakout Above $3,380 as Long-Term Drivers Stay Firmly in Place

Tariff tensions and policy shifts continue to drive short-term moves in gold prices. Rising debt and fiscal uncertainty could support gold despite higher bond yields. Key levels: break below $3300…

The Anchoring Problem and How to Stop Letting It Hurt Your Returns

Market perspective is essential in avoiding investing mistakes. With the media constantly pushing a “Markets In Turmoil” narrative, it’s no wonder that investor sentiment recently reached some of the lowest…

Stocks Week Ahead: Treasury Auctions, Tech Weakness May Weigh on Market Sentiment

The primary focus this week will remain on the bond market, with the Treasury auctions drawing significant attention. On Tuesday, the Treasury will auction a , followed by a on…

US Dollar Finds Support After Tariff Delay, but Growth Concerns Linger

In a move that has left financial markets reacting cautiously, US President Donald Trump has extended the deadline for trade negotiations with the European Union, boosting the and providing some…

Part 2: History Shows Investors Should Mind the ‘Kindleberger Gap’

Last week, I explored why investors should mind the This week, the theme continues with a piece from Martin Wolf, who writes, “Kindleberger argued that the stability of an open…

S&P 500 E-mini Outside Bear Bar Pullback

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all…

Week Ahead: Core PCE, Tariff Fallout, and a Crucial Test for Treasury Yields

The table below is published by Briefing.com every weekend and provides good detail on the coming week’s economic data releases. Since the quarterly data – including Q4 ’24 – has…