-

Meta’s stock has gained after every quarterly report this year, boosting investor confidence.

-

Strong ad revenue growth and rising AI investments remain key drivers of Meta’s outlook.

-

If Q3 results meet expectations, the stock could break above $800 to new highs.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

This year, stock has mostly rewarded investors with gains after each quarterly report. The market expects another strong performance this time too, judging by the large number of analysts raising their forecasts. Investors are mainly watching how fast Meta’s advertising revenue is growing, since it is key to the company’s financial health, and how much it is investing in artificial intelligence.

Technically, after a brief pullback, buyers are now targeting new record highs, just below $800 per share.

Meta’s Growing Edge in the AI Investment Race

Artificial intelligence has dominated stock market conversations in recent years. Major tech companies are racing to invest heavily in AI to avoid falling behind in this fast-moving shift. Investors closely track these AI-related expenses in quarterly reports, as they show how seriously each company is preparing for the future. For Meta, the key benchmark is the $66–72 billion investment it announced earlier this year, which could rise to as much as $100 billion by 2026.

Advertising remains Meta’s main revenue driver, and it will likely determine the overall tone of its quarterly results. Analysts tracked by FactSet expect ad revenue to reach about $48.5 billion, marking a 21.6% increase from last year, nearly matching the previous quarter’s 21.5% growth. Some concerns, however, center on rising costs and potential losses tied to Meta’s ResearchLab, which leads its generative AI efforts, as well as spending on VR-supported programs and games.

Market Expects Another Strong Quarter

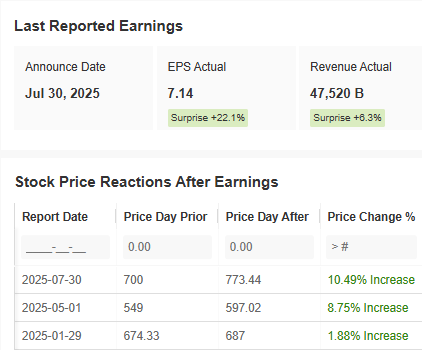

Each quarterly report this year has triggered an immediate rise in Meta’s stock, with gains growing each time. Investors have found little to be disappointed about in any of the company’s results so far.

Source: InvestingPro

For the upcoming Q3 2025 results, market expectations point to stronger performance than the same period last year. Analysts have also shown strong optimism, with 31 raising their forecasts and only one lowering them.

Source: InvestingPro

If Meta continues its streak of positive market reactions this year, the stock could soon break into new record highs.

Meta Technical Analysis

After failing to reach new record highs, Meta’s stock moved into a sideways trend, trading between $690 and $790 per share.

Meta’s stock is currently trending upward after holding firm at the lower end of its recent consolidation range. If the company’s results meet expectations, the stock could push past $800 to reach new record highs. However, a drop below $690 could signal renewed weakness, with the next support levels at $660 and $630 per share.

****

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

- AI-managed stock market strategies re-evaluated monthly.

- 10 years of historical financial data for thousands of global stocks.

- A database of investor, billionaire, and hedge fund positions.

- And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.