- US-China talks soften after rare earth export tensions, boosting stocks and stabilizing currencies.

- Federal Reserve signals another rate cut, with December meeting pricing in additional easing.

- EUR/USD tests key 1.1630 support, targeting 1.1550 if broken, resistance at 1.1720.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

After Beijing announced restrictions on rare earth exports, the White House initially reacted strongly. However, both sides are now showing willingness to continue talks. This softer stance has brought moderate optimism to stock markets, which are rising in both the US and Europe, while currency markets remain stable, with the euro trading around $1.16–$1.17.

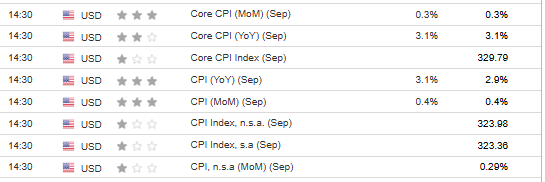

Meanwhile, the ongoing US government shutdown and lack of major economic updates are unlikely to stop the from cutting interest rates later this month. Important expected this Friday may show a slight rise in the CPI to 3.1% year-on-year.

Will the US and China Strike an Agreement?

At this stage, both China and the U.S. have too much to lose to halt talks and rely solely on high tariffs and export controls. That is why Treasury Secretary Scott Bessent met with Chinese Vice Premier Lifeng, with discussions described as generally productive.

President Donald Trump also suggested that the November 1 deadline for the full 100% tariff may change, and negotiations will continue. Following these developments, the US dollar strengthened locally and may continue to do so if positive news from the Washington-Beijing talks persists.

The negotiations are expected to lead up to a Trump-Xi meeting in late October or early November in South Korea. However, given the complexity of global trade and the many points of potential disagreement, it is unlikely that a single meeting will produce comprehensive solutions, as past talks—like those between Trump and Putin—have shown.

Fed Signals Point Clearly to Another Rate Decision

Market expectations suggest another US interest rate cut next week. Fed officials, including Alberto Musalem and Stephen Miran, have indicated that at least moderate monetary easing is the right approach. However, this cut is already priced into the market, so unless there is a surprise, attention will likely shift to the December meeting, where another 25 basis point cut is expected with over 90% probability.

Battles to Maintain Downward Momentum

The recent decline in EUR/USD, which began late last week, has reached a key support area near 1.1630, where it aligns with the 50% Fibonacci retracement level.

If this support area breaks, EUR/USD could continue lower, with a target near 1.1550. If the support holds and buying interest appears, the 1.1720 level remains the main resistance.

****

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

- AI-managed stock market strategies re-evaluated monthly.

- 10 years of historical financial data for thousands of global stocks.

- A database of investor, billionaire, and hedge fund positions.

- And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.