After starting the third quarter on a slightly negative note Tuesday with a 0.11% decline, the rebounded yesterday, gaining 0.47%. That was enough for the main U.S. stock market index to post a double all-time high—closing at 6227.42 points and reaching an intraday peak of 6227.60.

Hopes of easing tensions in Trump’s trade war helped fuel the gains, as the U.S. president announced a trade agreement with Vietnam.

Markets also brushed off disappointing private payroll data from , suggesting that investors expect the Fed to be forced into cutting rates in response to a weakening labor market.

Expectations of a are further supported by Trump’s ongoing pressure on Fed Chair Jerome Powell. Frustrated by the lack of action, Trump even called for Powell’s resignation in a message posted last night on his Truth Social network.

Looking ahead to Thursday, all eyes will be on the June Non-Farm Payrolls () report—a more influential counterpart to the ADP data.

In any case, the trend and outlook remain positive for the S&P 500, a view also supported by technical indicators.

In fact, the index flashed a major bullish signal yesterday, as the 50-day moving average crossed above the 200-day moving average. This so-called “Golden Cross” often precedes strong upward momentum and tends to attract new buyers.

In Search of the Best S&P 500 Stocks for July and Beyond

Against this backdrop, we set out to identify the “best” S&P 500 stocks to buy in the weeks ahead, aiming to capture further upside.

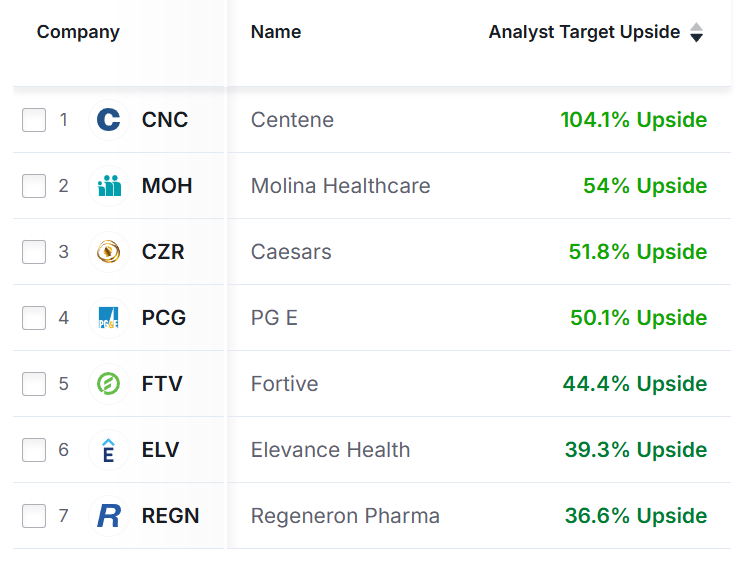

To begin, we used the Investing.com Stock Screener to search for analysts’ favorite S&P 500 picks.

Specifically, we filtered for S&P 500 stocks covered by at least 10 analysts and showing the highest upside potential based on their average price targets.

Here are the top 7:

Source: InvestingPro

However, a closer look at these stocks reveals that not all of them are in ideal shape. Some have weak financials, while others have suffered steep losses in recent weeks.

Analyst targets can be helpful—but they shouldn’t be the only factor guiding investment decisions.

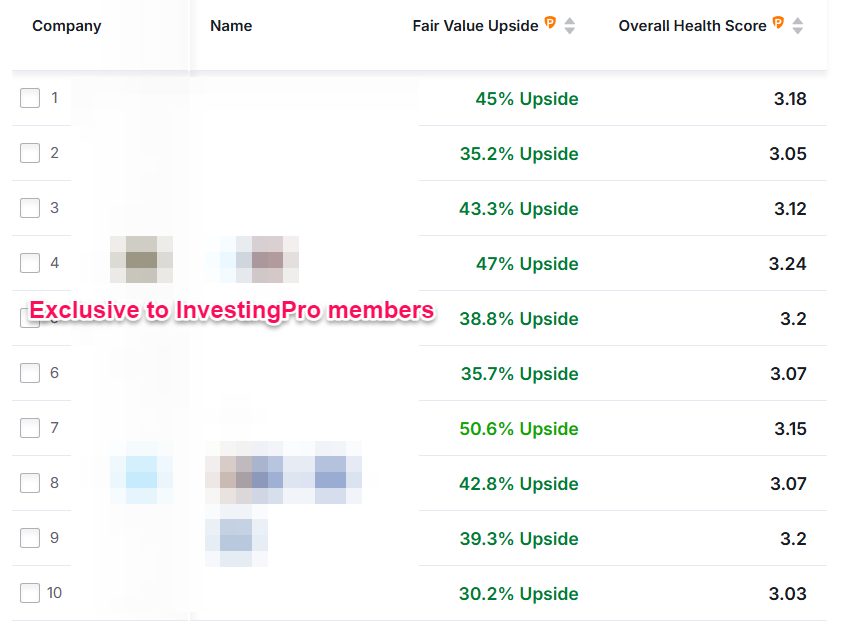

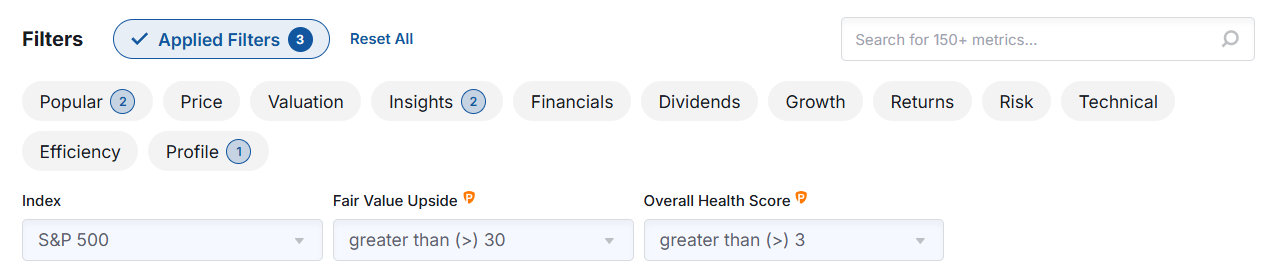

So, we conducted a second screen using InvestingPro’s exclusive indicators: Fair Value and Health Score.

Reminder: InvestingPro’s Fair Value aggregates multiple trusted valuation models to provide an intelligent price estimate for each stock. The Health Score evaluates a company’s financial strength based on various metrics and peer comparisons.

For this screen, we focused on S&P 500 stocks that met both of the following criteria:

This refined search yielded 10 stocks:

Unlock exclusive access — this list is reserved for premium members only!

Note that these stocks offer upside potential ranging from +30.2% to +50.6%.

InvestingPro Fair Value and Health Score are advanced screener features available to InvestingPro Pro+ subscribers. If you have access, you can replicate this search using the same parameters.

Source: InvestingPro

It’s also worth mentioning that some of the analysts’ top-rated stocks appeared in both screens. This confirms that by combining multiple filters—valuation, financial health, and analyst sentiment—you can uncover a broader range of high-quality opportunities, rather than relying on a single perspective.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.