- USD/JPY is stuck in a safe haven standoff with no clear winner.

- With central banks cautious and Middle East risks simmering, a breakout could hinge on geopolitics.

- All eyes on 148—can bulls push through, or will the range hold yet again?

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

On the currency pair, where both components are considered so-called safe havens, we’re observing a tug-of-war with no clear advantage for either side. On one hand, central banks remain passive, having left interest rates unchanged during their June meetings. On the other hand, the market is clearly uncertain about developments in the Middle East. Under these conditions, we may see a prolonged sideways trend—although a resumption of the conflict in the Middle East could spark increased volatility, not only in this market but also in the market. Beyond military developments, attention should also be paid to the ongoing Washington–Tokyo trade agreement negotiations, which, according to official statements, have not led to any breakthroughs at this stage.

Bank of Japan Remains With Cautious Stance

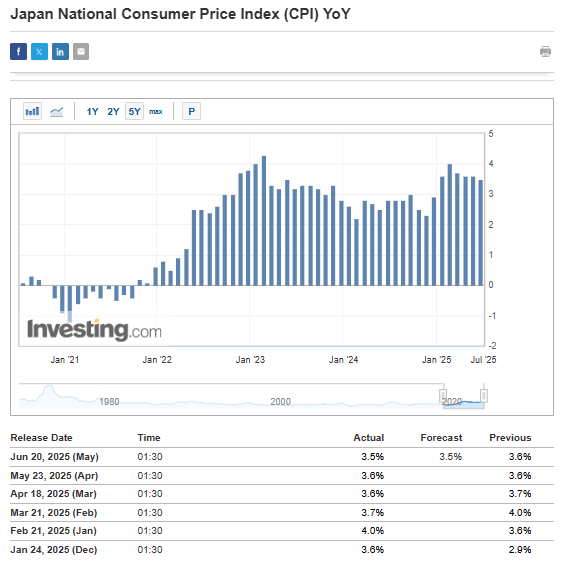

At the ’s latest meeting earlier this month, interest rates were once again left unchanged. This stance may come as a surprise, given that inflation has remained above the Bank’s defined target for more than three years. One symbolic example is the price of rice, which rose by more than 100% year-on-year in May. In response, the Japanese government decided to release strategic reserves of the commodity in an effort to curb price increases. However, this move is likely to have only a short-term impact (similar to previous BOJ interventions in the foreign exchange market) and is far from sufficient over the longer term.

Figure 1: Inflation Dynamics in Japan

Japan’s monetary policy officials continue to express concern about the pace of , especially amid uncertainty regarding the outcome of U.S. trade negotiations. According to BOJ Governor Ueda’s latest statement, the Bank is prepared to raise interest rates further in the coming months. However, this seems more like verbal intervention than a firm signal of concrete action.

At its June meeting, the effectively maintained the status quo—retaining its broadly hawkish stance but leaving the door open for possible rate cuts in September, depending on the development of the tariff war. Meanwhile, several dovish voices have emerged in recent days suggesting that another cut could come as early as July. Among these are Michelle Bowman and Christopher Waller. Bowman was recently nominated by Donald Trump to serve as Vice Chair for Supervision at the Federal Reserve. Her views may align closely with those of the current President, who has made it clear he supports steep interest rate cuts.

Key Resistance on USDJPY Defended

The latest bullish push on the USDJPY pair led to a test of a key resistance zone in the 148 yen per dollar region. However, any attempt to break above this level was quickly met with a strong wave of selling pressure, keeping the pair locked in a medium-term consolidation.

Figure 2: Technical Analysis of USDJPY

The next directional move will likely depend on whether the pair eventually breaks out of the 143–148 yen per dollar range—and in which direction.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.