The Russel 2000 Index, a major US small-cap benchmark, has moved higher over the last four trading sessions. It gained 7.8% during this period. The S&P 500, in comparison, rose 4.2%. This makes the Russell 2000’s advance almost twice as large.

The shift in expectations for a is the key reason. Traders are again pricing a December 10 rate cut as very likely. On Thursday, the implied probability jumped above 80%. Last week, those odds had dropped below 30%.

Small businesses react the fastest to Fed interest rate changes, for several reasons:

-

Smaller companies tend to rely more on floating-rate debt and short-term financing, while larger firms often raise money by selling long-term bonds. When interest rates fall, borrowing costs for smaller firms decline right away. Their interest expenses drop quickly, and that can have a meaningful impact on their profits.

-

Small-cap companies also earn most of their revenue inside the US. They track the domestic economy more closely than large multinational corporations, which make money in many regions. Fed rate cuts may lift global sentiment, but the biggest effects show up in the US economy first. That focus gives smaller US firms an edge when markets shift toward lower rates.

- Small-cap stocks can trade at much lower valuations than large-cap stocks, especially after long periods of high interest rates. This valuation gap can create appealing entry points for investors looking to buy into the next phase of market cycles.

- Falling interest rates can push investors to move money from large stocks into smaller companies with higher growth potential.

- Research shows small-cap stocks have often delivered stronger returns than large stocks when interest rates are falling.

As more US banks expect rate cuts to continue into 2026, the recent strength in small-cap stocks may carry forward. has already signaled cuts for March and June 2026.

This shift becomes even clearer as questions grow around the heavy spending behind big AI stocks. Investors are beginning to search for cheaper, faster-growth plays that trade on more realistic valuations. Many see small-caps as a sensible alternative while the AI surge cools and market leadership broadens.

Finding the Top Russell 2000 Stocks to Buy

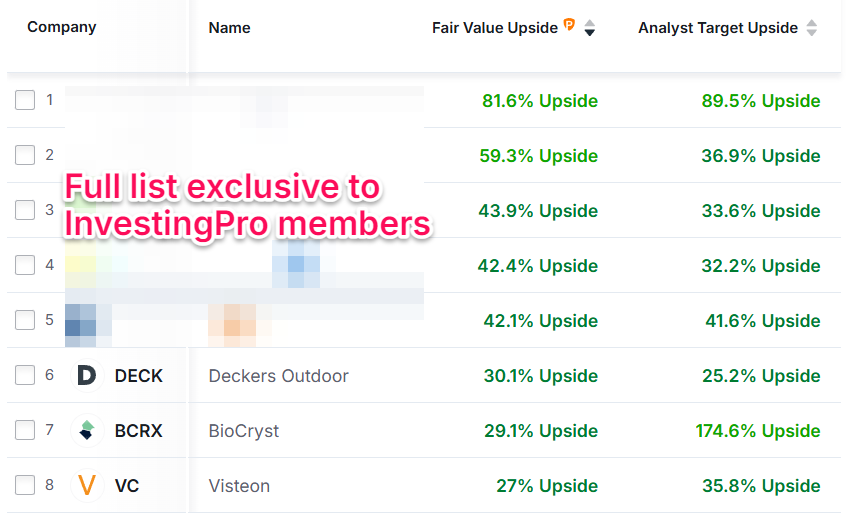

Against this backdrop, we scanned the Russell 2000 for opportunities using the Investing.com screener. We filtered stocks based on the points below:

- Russell 2000 stocks

- Potential upside of over 25% according to InvestingPro Fair Value

- Stocks followed by at least 10 analysts

- Stocks rated “Buy” or “Strong Buy” by analysts

- Potential upside of more than 25% according to analysts’ average target

- InvestingPro health score above 2.5/5

This research has enabled us to identify 8 opportunities:

ATTENTION: Although the basic functions of the Investing.com screener are available free of charge, in this search we used metrics reserved for InvestingPro, Pro+ plan subscribers.

These US small caps span multiple sectors and are undervalued by 27% to 81.6% per InvestingPro Fair Value. Analysts see potential gains of +25.2% to +174.6%.

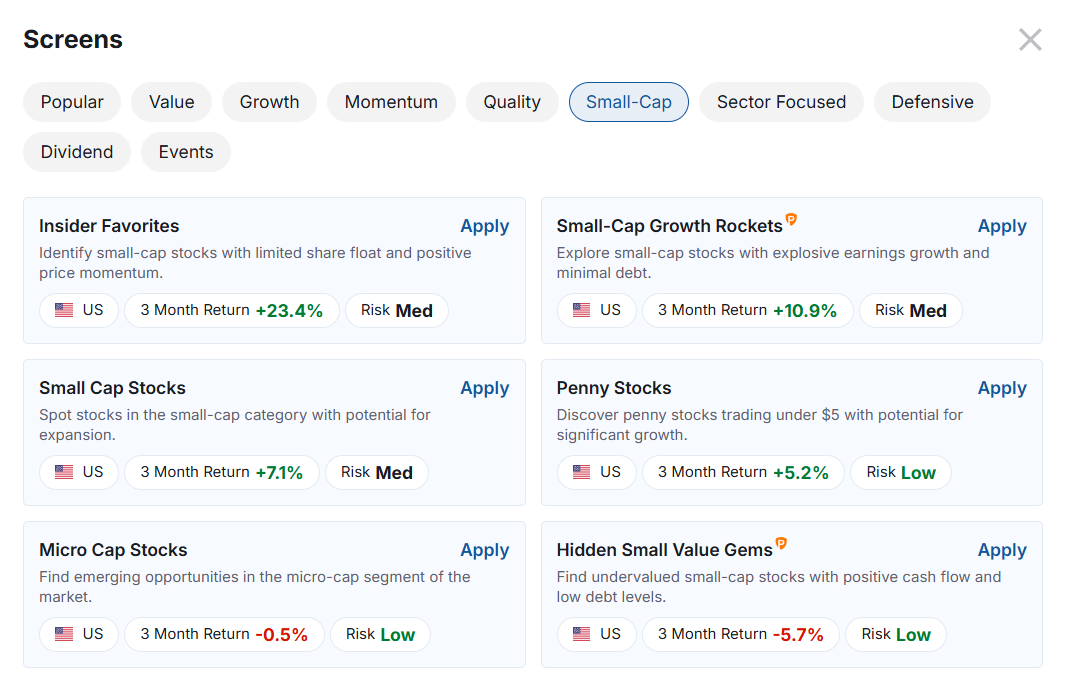

Our approach isn’t the only way to spot small-cap opportunities. The Investing.com screener also provides six pre-set searches for US small caps:

Please keep in mind that some of these pre-configured searches are available only to InvestingPro and Pro+ subscribers.

If you’re not yet an InvestingPro subscriber and want to explore the opportunities mentioned in this article along with access to InvestingPro tools, you can now take advantage of the 60% off Black Friday discount by clicking the button below.

Finally, please note that the features mentioned in this article are far from being the only InvestingPro tools useful for market success. In fact, InvestingPro offers a wide range of tools that enable investors to always know how to react in the stock market, regardless of market conditions. These include:

- AI-managed stock market strategies that are re-evaluated monthly.

- 10 years of historical financial data for thousands of global stocks.

- A database of investor, billionaire, and hedge fund positions.

- And many other tools that help tens of thousands of investors outperform the market every day!

Tens of thousands of investors are already using InvestingPro to outperform the market. Why shouldn’t you?

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.