Several stocks in the US market have recently experienced short-term pullbacks, even as their overall upward trends remain intact. These are not signs of a breakdown, but rather healthy corrections within a longer growth trajectory, often creating attractive entry points for investors who know where to look.

Investing.com’s stock screener is a great tool to help pick companies for any investment portfolio. It offers many indicators that you can adjust freely, giving almost unlimited ways to customize your search. Today’s analysis will focus on choosing companies that have recently faced a temporary technical pullback.

The indicator settings are designed to find companies that are in a temporary pullback within an overall upward trend but still have good growth potential, based on the InvestingPro Fair Value Index. Besides technical indicators, other groups of indicators give a fuller view of the company’s financial and fundamental health, helping investors make better choices.

One company to watch, out of the three we found, is Okta Inc (NASDAQ:). Even though the firm’s share price has been going down after its quarterly results, it still has chances to move up. Let’s understand how we found this stock using the screener.

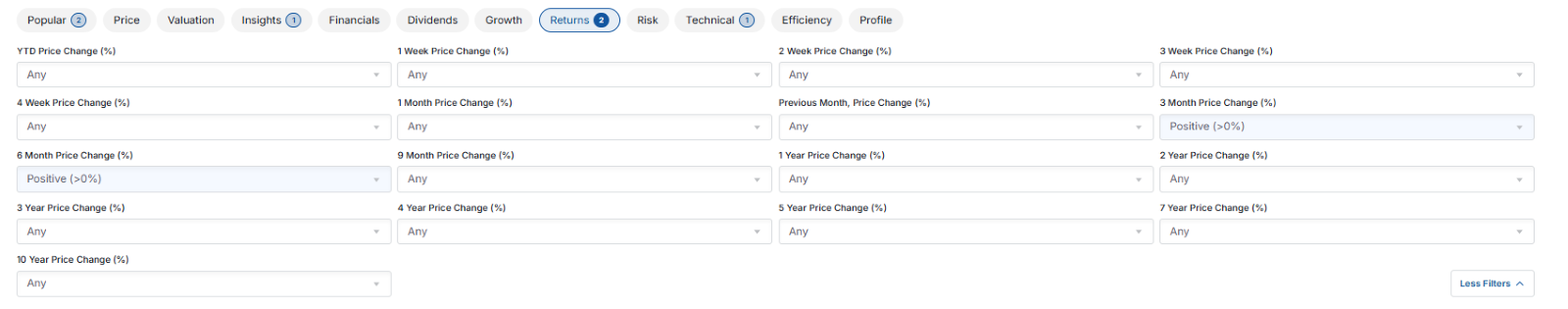

How to Set Your Stock Scanner for Correction Strategy

The main goal of a stock portfolio using a correction strategy is to find companies that may be in a medium- to long-term upward trend. The best way to do this is to first choose companies with positive returns over the past 3 and 6 months.

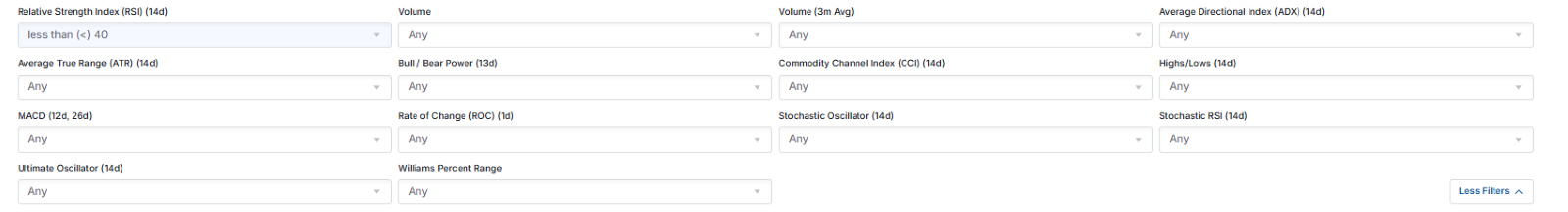

The RSI indicator, set below 40 points, will be used to identify companies that are currently in a correction phase.

We add a general fair value indicator to include only companies with at least 5% upside potential. Using the scanner with these settings, we found eight companies from the US market that meet the criteria.

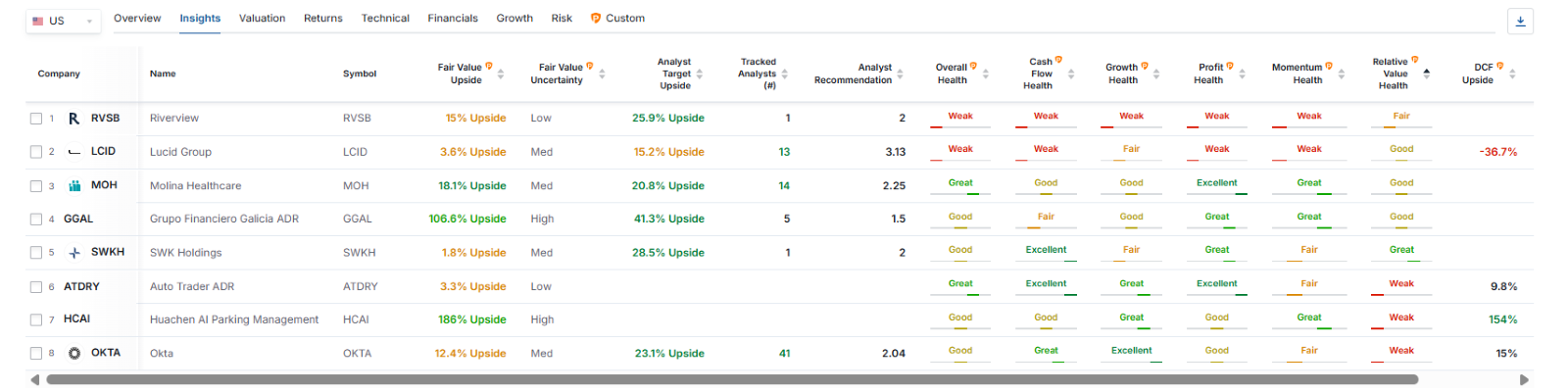

The top panel shows 9 categories, which allow the user to view the selection based on different fundamental indicators.

The ’Insight’ panel provides a view of how each company ranks in terms of growth potential and overall financial ratings. In this group, Okta, Lucid Group Inc (NASDAQ:), and Molina Healthcare (NYSE:), among others, stand out.

Let’s take a closer look at Okta, where both analysts and InvestingPro’s Fair Value indicate a possible continuation of the long-term uptrend.

Okta’s Stock Price Shows a Clear Rebound

Okta is a strong example of a company that fits the outlined strategy. At the end of last week, its stock experienced a significant sell-off right after the quarterly results, even though it beat consensus expectations in key areas. The drop was mainly due to cautious forecasts for the coming quarters, driven by uncertainty in the macroeconomic environment.

However, when looking at the chart, the supply gap did not trigger any technical signal suggesting a reversal of the uptrend that has been in place since last August.

The main goal for buyers is to keep the stock price above the accelerated uptrend line, which should lead to a fair value around $118 per share. The key target remains the recent high of $127 per share.

If the price falls below the $88 support level, this would break the current trend and could lead to a deeper decline, possibly down to around $72.

***

InvestingPro offers a variety of other investment approaches tailored to different goals and market conditions. These strategies cover areas such as growth, value, income, and risk management, helping investors build and adjust portfolios effectively. By combining technical and fundamental analysis, InvestingPro’s tools support informed decision-making across diverse market environments.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.”