- is consolidating between $1.34 and $1.36; breakout chances rise post-holiday, data-dependent.

- US Fed likely to cut rates by 0.25%, impacting GBP/USD amid UK policy indecision.

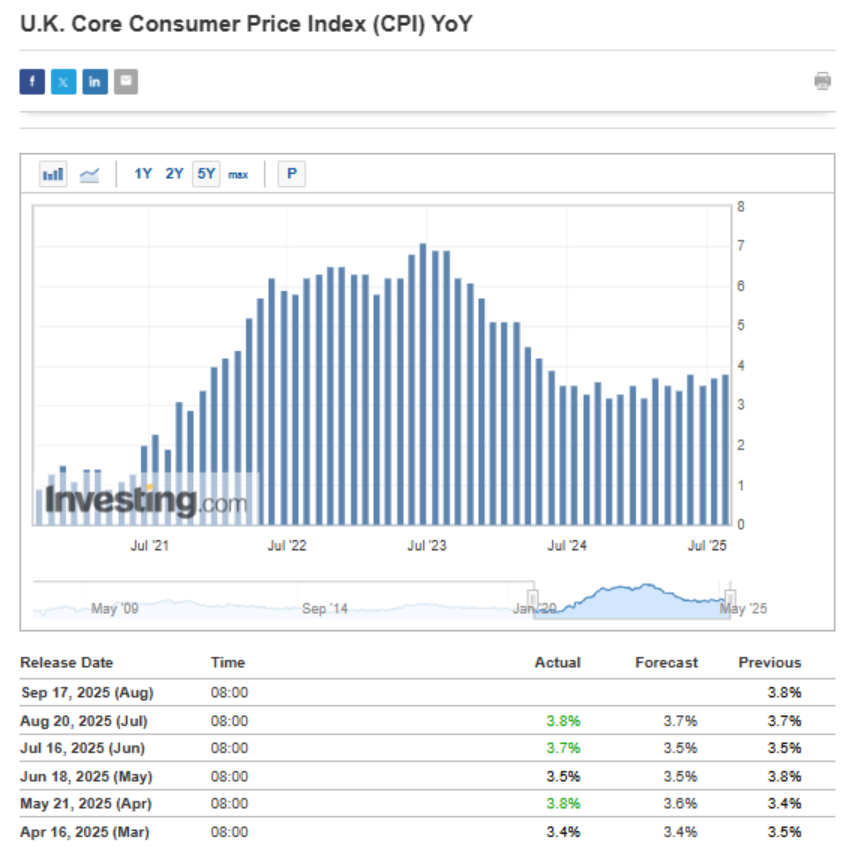

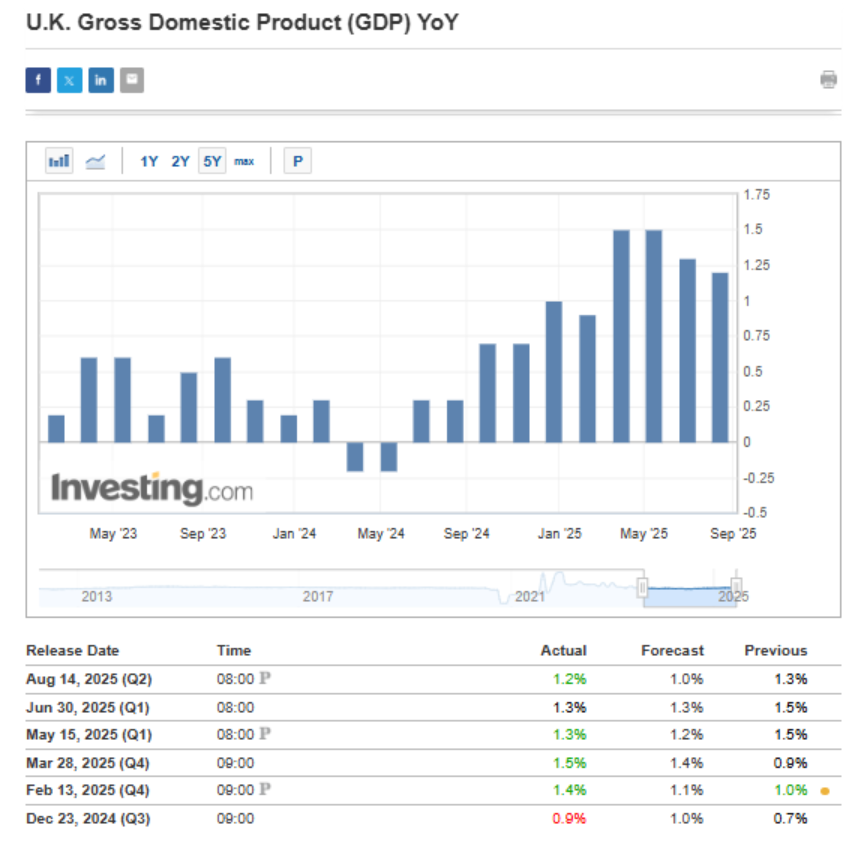

- Stagflation risk grows in UK as inflation rises but growth momentum slows.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

In the second-half of August, the GBP/USD exchange rate exhibited low volatility and stayed within a narrow range. However, with the end of the holiday season, this scenario may change. The UK’s economic environment presents several challenges, as seen in the recent Bank of England meeting where policymakers were divided on interest rate decisions.

Meanwhile, the U.S. Federal Reserve is expected to make a relatively straightforward decision to reduce interest rates by at least 0.25%. This potential divergence in monetary policy between the UK and the U.S. suggests that the British pound could strengthen against the U.S. dollar, possibly approaching levels just below 1.38 in the medium term.

Stagflation Looms as a Genuine Threat to UK

The decision to cut interest rates by another 25 basis points was narrowly supported by the dovish camp, prevailing by just one vote, while no members voted for a 50 basis point cut. This indecision within the council is largely due to inflation beginning to rise again, with recent figures coming in higher than expected.

Given these high inflation readings, the decision to cut rates is already seen as quite controversial. As a result, the market currently anticipates that there will be no further rate reductions this year. Those in favor of more monetary easing are primarily focused on boosting economic growth. Although the growth figures exceeded forecasts on a quarterly basis, they indicate a slowdown in upward momentum.

Given this situation, the possibility of stagflation—a combination of slow economic growth and high inflation—appears increasingly plausible. Decision-makers may be left choosing the lesser of two evils. Despite rising inflation and no official recession, the most likely course of action seems to be slowing down rate cuts by the end of the year.

Important Releases Ahead of Fed meeting

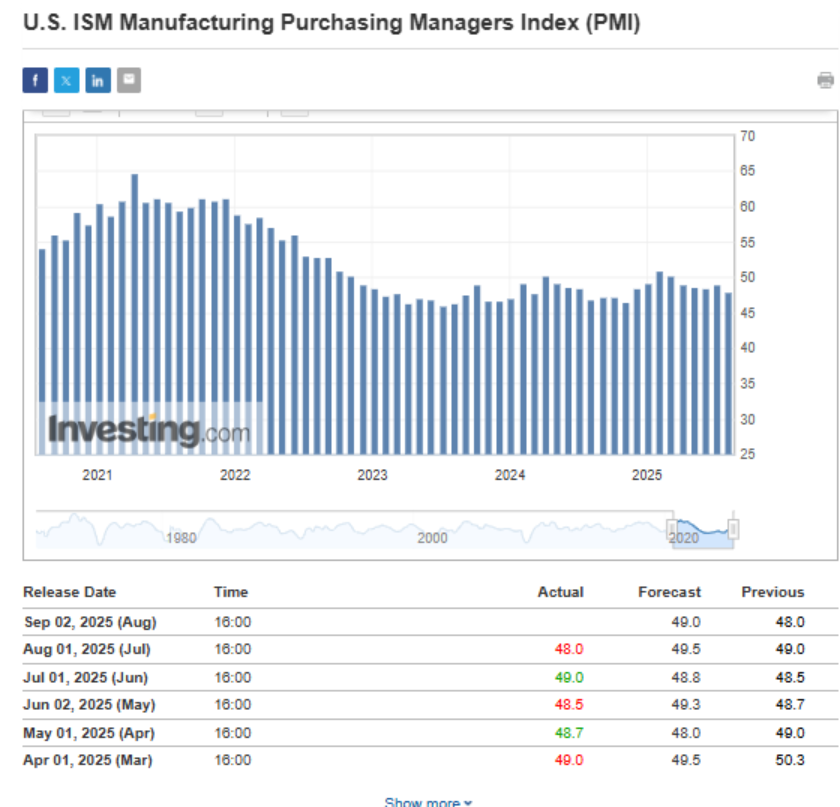

This week, several key economic reports are set to be released, which could influence the scale of interest rate cuts at the upcoming Federal Reserve meeting. The first of these is the ISM manufacturing data, which has been teetering between signs of recovery and indications of a slowdown for some time.

However, the critical information will come on Friday with the release of labor market data and revisions for previous months. These figures will be pivotal in shaping expectations for the Federal Reserve’s actions. The market will be particularly focused on whether the data aligns with or deviates from the following consensus estimates:

If the reported figures are clearly weaker than expected, a 25 basis point cut would become a certainty, and even a 50 basis point cut could be considered. Such moves would likely lead to a significant weakening of the US dollar.

GBP/USD Technical Analysis

Since mid-August, GBP/USD has been trading in a consolidation range between $1.34 and $1.36. As the holiday period ends, the likelihood of a breakout is increasing, and this will largely depend on the economic data released this week.

If a breakout occurs to the downside, it could lead to a repricing with a target around the strong support level of 1.32. Conversely, if buyers manage to break through the 1.36 resistance, there is potential for the price to move toward the peak area of 1.38.

****

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

- AI-managed stock market strategies re-evaluated monthly

- 10 years of historical financial data for thousands of global stocks

- A database of investor, billionaire, and hedge fund positions

- And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.