prices are approaching the $40 per ounce mark, a key psychological level that supply pressures have managed to hold for now. But with demand growing faster than supply and the weakening due to disappointing , further price pushes are likely.

The Silver Institute expects another supply shortfall in 2025, which may worsen in the coming years. This is mostly due to rising demand from the energy and electric vehicle industries. Around half of all silver produced goes to industrial use, with solar energy alone using about 17%. At the same time, silver supply has been falling for nearly a decade.

Most silver is extracted as a byproduct of mining other metals, and only a quarter comes from direct silver mining. This makes it hard to quickly adjust supply to meet rising demand.

Global X Silver Miners ETF in a Strong Upward Trend

For those exploring investment opportunities in the silver market, the Global X Silver Miners ETF (NYSE:) is worth watching. Its value has been steadily rising. Right now, it is nearing a key level of long-term resistance around the $54 price range, where demand may face a challenge.

If buyers manage to push past the $54 resistance level, a move toward the next major peak around $75 becomes more likely. However, this climb will probably take time.

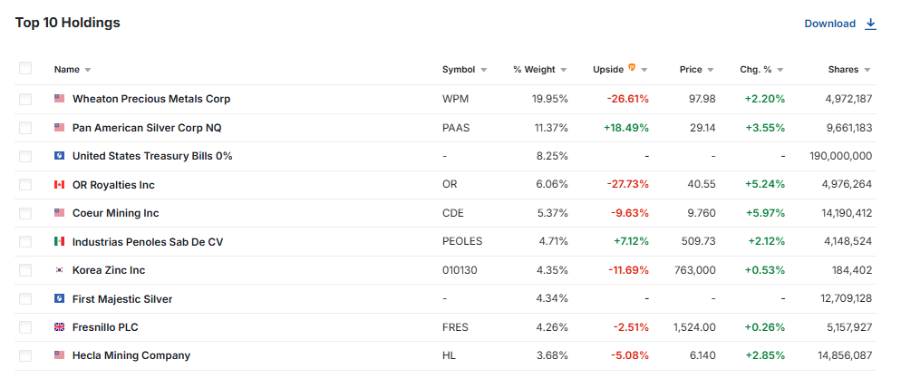

Looking at the ETF’s structure, key holdings include companies directly involved in silver mining, such as Wheaton Precious Metals (NYSE:) and Pan American Silver (NYSE:).

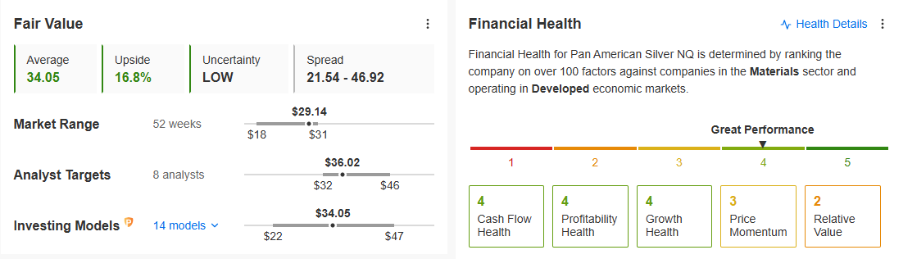

Between the two, Wheaton Precious Metals holds the largest weight in the ETF. However, from a fundamentals perspective, Pan American Silver appears stronger based on key indicators tracked by InvestingPro.

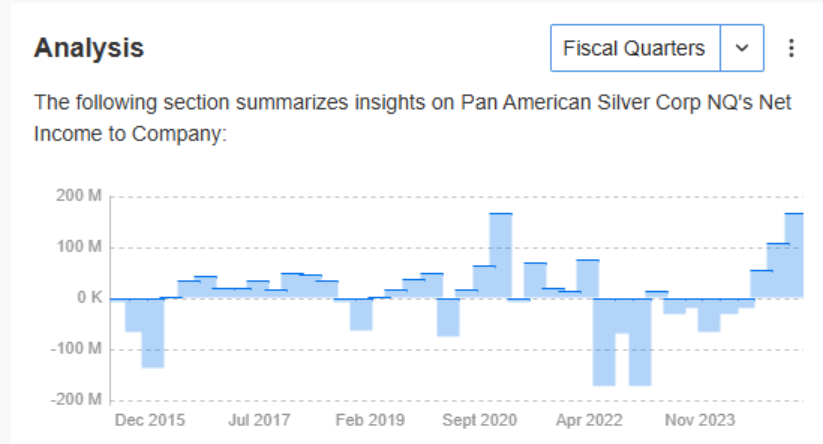

Over the last three quarters, has consistently grown its net profit. If this trend continues, the stock could climb to new highs, potentially reaching levels last seen in mid-2021.

The key factor influencing both the individual companies and the entire fund remains the price of silver, which still shows potential for further gains.

End of Silver Price Correction?

At the end of July, silver prices were in a correction phase, briefly dipping to around $36.50 per ounce. That level held firm, and now it appears the pullback has ended, with buyers starting to take control again.

A move above $38 per ounce would be the first technical signal that the upward trend is back on track. This could open the door for another push toward the $40 per ounce level.

****

Be sure to check out all the market-beating features InvestingPro offers.

InvestingPro members can unlock a powerful suite of tools designed to support smarter, faster investing decisions, like the following:

Built on 25+ years of financial data, ProPicks AI uses a machine-learning model to spot high-potential stocks using every industry-recognized metric known to the big funds and professional investors. Updated monthly, each pick includes a clear rationale.

The InvestingPro Fair Value model gives you a clear, data-backed answer. By combining insights from up to 15 industry-recognized valuation models, it delivers a professional-grade estimate of what any stock is truly worth.

WarrenAI is our generative AI trained specifically for the financial markets. As a Pro user, you get 500 prompts each month. Free users get 10 prompts.

The Financial Health Score is a single, data-driven number that reflects a company’s overall financial strength.

- Market’s Top Stock Screener

The advanced stock screener features 167 customized metrics to find precisely what you’re looking for, plus pre-defined screens like Dividend Champions and Blue-Chip Bargains.

Each of these tools is designed to save you time and improve your investing edge.

Not a Pro member yet? Check out our plans here or by clicking on the banner below. InvestingPro is currently available at up to 50% off amid the limited-time summer sale.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.