WTI crude prices held steady on Monday, but a series of positive developments has lifted hopes for a rebound in oil.

OPEC+ — which includes OPEC members and allied producers — agreed on Sunday to a modest output increase of 137,000 barrels per day in December and to pause any further hikes during the first quarter of next year.

Following the announcement, Morgan Stanley raised its forecast for in the first quarter of 2026 from $57.50 to $60 per barrel, citing both the OPEC+ decision and recent actions targeting Russian oil assets.

Analysts at Canadian bank RBC noted that Russia remains an unpredictable source of supply following US sanctions on major producers and , as well as recent attacks on energy infrastructure.

These developments ease concerns raised last month by the International Energy Agency, which warned that the global oil market could see a surplus of up to 4 million barrels per day next year. OPEC, however, expects supply and demand to remain broadly balanced over the same period.

10 Undervalued Oil Stocks With Up to 83% Upside

Against this backdrop, oil and gas stocks may offer compelling opportunities in the months ahead.

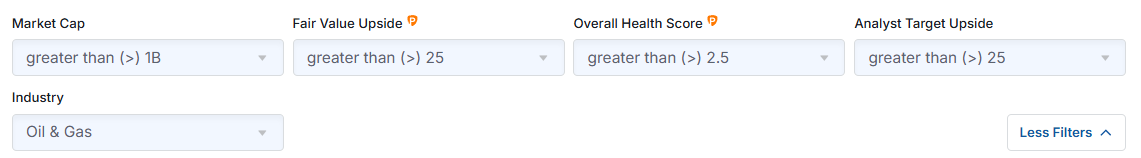

Using the Investing.com screener, we looked for companies with a market capitalization above $1 billion that appear undervalued based on current models and carry a positive outlook from analysts.

More specifically, we applied the following criteria for our search:

- Oil & Gas industry

- Market capitalization in excess of $1 billion

- Potential upside of more than 25% according to InvestingPro Fair Value

- Potential upside of more than 25% according to average analysts’ guidance

- InvestingPro health score above 2.5/5

This research helps identify oil stocks that appear undervalued and have strong support from analysts.

Note: Although the basic functions of the Investing.com screener are available to all free of charge, some of the criteria used here are reserved for InvestingPro and Pro+ subscribers.

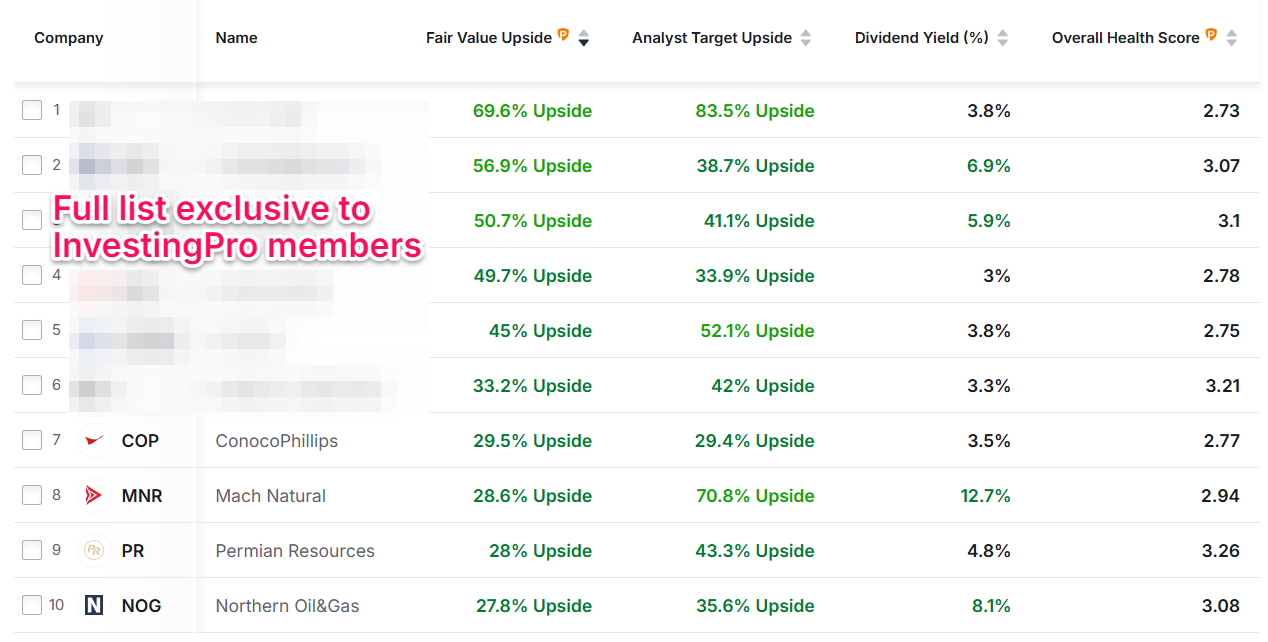

This detailed screening helped us identify 10 promising stocks.

Are you an InvestingPro (Pro+) subscriber? Click here to access this screener search.

These stocks appear undervalued by 27.8% to 69.6% based on InvestingPro’s Fair Value model, while analysts project an average upside of 29.4% to 83.5%.

Notably, the stock with the highest upside in InvestingPro’s valuation also ranks as the top pick among analysts.

Beyond their growth potential, all these oil and gas stocks offer dividends with annual yields ranging between 3% and 12.7%.

Finally, please note that the features mentioned in this article are far from being the only InvestingPro tools useful for market success. In fact, InvestingPro offers a whole range of tools enabling investors to always know how to react in the stock market, whatever the conditions. These include:

- AI-managed stock market strategies re-evaluated monthly.

- 10 years of historical financial data for thousands of global stocks.

- A database of investor, billionaire, and hedge fund positions.

- And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.