Wall Street’s second quarter earnings season begins next week, when notable names like JPMorgan Chase (NYSE:), Citigroup (NYSE:), Wells Fargo & Company (NYSE:), BlackRock (NYSE:), Bank of America (NYSE:), Goldman Sachs (NYSE:), Morgan Stanley (NYSE:), Johnson & Johnson (NYSE:), United Airlines (NASDAQ:), and Netflix (NASDAQ:) all deliver their financial results.

With the trading at all-time highs after a robust rally from its April lows, investors are now looking to corporate earnings to determine whether the market’s momentum is sustainable.

Source: Investing.com

From technology to manufacturing, each S&P 500 sector is facing significant headwinds this quarter, and the upcoming earnings season will be a telling indicator of how these companies are adapting and forecasting future demand.

Here’s what to watch as the Q2 earnings season unfolds:

Tariffs: The Unseen Earnings Villain

The biggest wild card this quarter is the sudden escalation in U.S. trade tariffs under President Donald Trump. On July 8, sweeping new 50% tariffs were announced on imported , with threats of more to come on semiconductors and pharmaceuticals. The deadline for 14 nations to cut deals is set for Aug. 1, but so far, only the UK and Vietnam have reached agreements.

The risk: these tariffs could squeeze profit margins and disrupt supply chains, especially for multinationals and manufacturers. Analysts estimate that tariffs could reduce S&P 500 earnings growth by approximately 2 percentage points in Q2.

Source: Investing.com

While a 7% drop in the during Q2 provides some offset for U.S. exporters, the true bottom-line impact will only start to show up in these earnings reports.

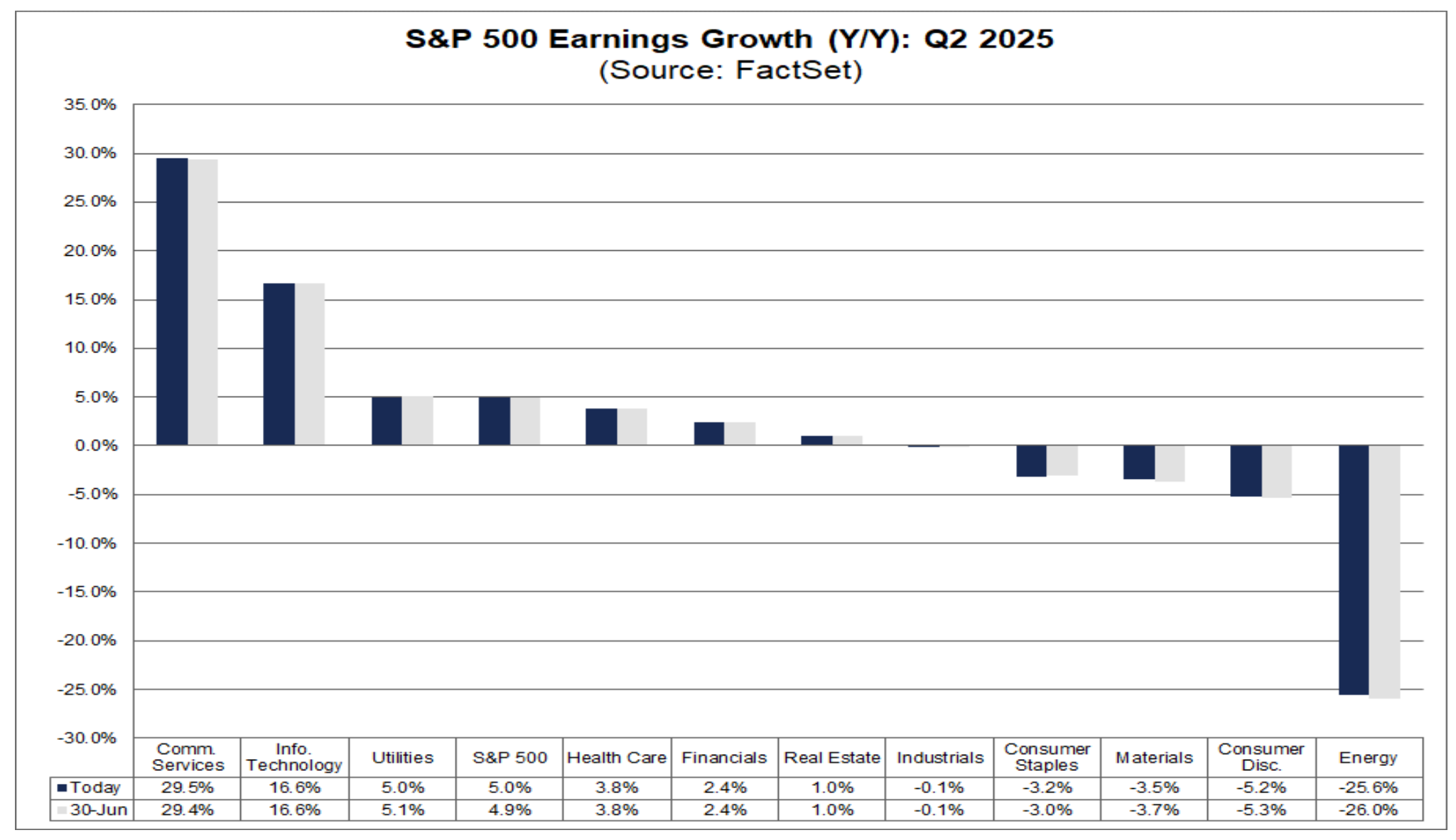

Earnings Growth Expectations

S&P 500 earnings are expected to grow by 5.0% year-over-year in Q2, according to FactSet, a sharp deceleration from the 13.7% growth posted in Q1. While this marks the slowest growth pace since Q4 2023, a low bar could provide opportunities for companies to exceed expectations, provided they navigate the season’s challenges effectively.

Source: FactSet

Sector Performance

: The sector is expected to report the highest annual earnings growth rate, at +29.5%. Some of the biggest names in the space include Meta Platforms (NASDAQ:), Netflix, Walt Disney (NYSE:), as well as Verizon (NYSE:), and AT&T.

: The information technology sector is also set to report robust earnings growth, driven by continued demand for AI and cloud computing. Companies like Nvidia (NASDAQ:), Microsoft (NASDAQ:), Alphabet (NASDAQ:), and Advanced Micro Devices (NASDAQ:) are likely to post strong results.

: Retailers and e-commerce companies face challenges from slowing consumer spending and rising costs. The sector includes notable companies like Amazon (NASDAQ:), Walmart (NYSE:), Home Depot (NYSE:), McDonald’s Corporation (NYSE:), and Coca-Cola (NYSE:).

: Energy companies, which includes oil and gas giants such as ExxonMobil (NYSE:), Chevron (NYSE:), and ConocoPhillips (NYSE:), may see lower profits due to declining oil and gas prices compared to last year.

Guidance for the Second Half

Monitoring corporate guidance will be critical, as forward-looking commentary on tariffs, cost pressures, and consumer demand could drive significant stock price swings.

Companies that signal resilience in the face of economic uncertainty will likely be rewarded, while those that fail to meet or beat consensus estimates risk outsized downside moves. In this environment, even minor disappointments in results or outlooks can trigger sharp pullbacks.

Key Stocks to Watch for Q2 Earnings Season

The U.S. stock market enters Q2 earnings season in a precarious position. The S&P 500’s nearly 28% rebound from April lows has pushed valuations to elevated levels, with the forward price-to-earnings (P/E) ratio hovering around 20.6, well above its long-term average of 15.8.

This frothy backdrop leaves little room for disappointment, particularly for the dominant tech and growth stocks that led the recent rally, as investors demand robust earnings growth to justify current prices.

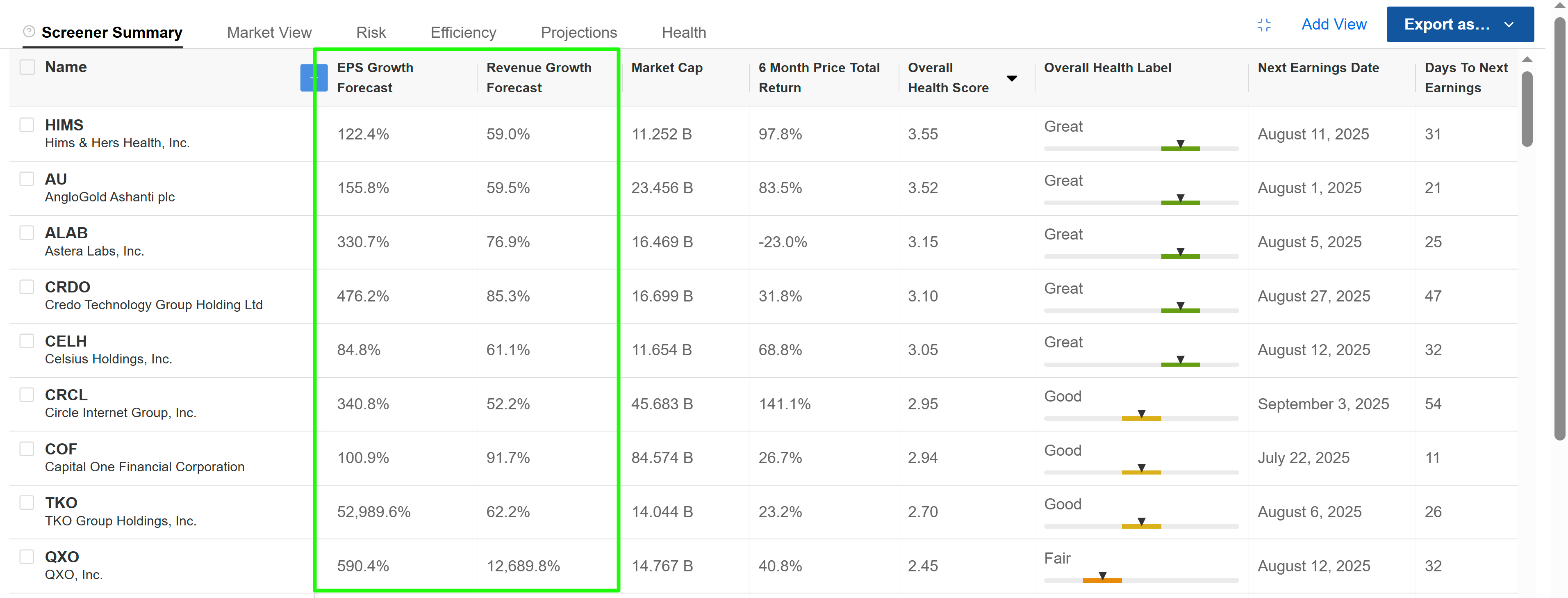

Given the current economic backdrop, I used the InvestingPro Stock Screener to search for companies that are forecast to deliver massive growth of more than 50% in both earnings per share and revenue. In total, just 19 stocks showed up.

Source: InvestingPro

Some of the notable names to make the cut include Capital One Financial (NYSE:), CoreWeave (NASDAQ:), Truist Financial (NYSE:), Circle Internet Group (NYSE:), AngloGold Ashanti (NYSE:), Credo Technology (NASDAQ:), Xpeng (NYSE:), Astera Labs (NASDAQ:), TKO Group Holdings (NYSE:), IONQ (NYSE:), Celsius Holdings (NASDAQ:), Hims Hers Health (NYSE:), and Tempus AI (NASDAQ:).

The Bottom Line

As investors navigate this high-stakes season, resilience and adaptability will be key. Whether the market can clear the low earnings bar or succumbs to policy-driven volatility remains to be seen, but Q2 earnings will undoubtedly shape the trajectory of 2025’s second half.

Savvy investors will need to be highly discerning, focusing on companies with clear visibility into their future earnings power and resilience to external shocks.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.