After more than a month of sideways movement, looks ready to resume its upward trend. The next step for bulls is to break above the $39 per ounce mark, setting a new high for this bull market. Even though silver is already up around 30% this year, there is still room for more gains.

Yesterday’s stronger-than-expected data gave the a boost, which caused some pullback in silver prices. But the bigger drivers—like ongoing worries about the tariff war—are likely to keep the uptrend intact. For now, buyers are aiming to push prices past the $40 level.

Can Silver Still Catch Up to Its Record Highs?

Unlike , which keeps setting new highs in dollar terms, silver still has a long way to go to reach similar levels in this bull market. So the key question is—can silver catch up in the next few months?

That would be a tough climb and would depend on two major developments:

- A Dovish Fed: The would need to cut interest rates more aggressively, weakening the US dollar. This usually helps precious metals like silver. But for this to happen, there would likely need to be a deep recession and a sharp drop in .

- Tariffs on Silver: The US-Mexico trade conflict would have to escalate and start including silver in the list of taxed goods. Right now, silver is not affected, but with President Donald Trump’s unpredictable policies, investors cannot rule out a change. Since Mexico is the world’s largest silver producer, new tariffs could be a strong trigger for price increases.

Inflation Surprise Clouds Rate Cut Hopes

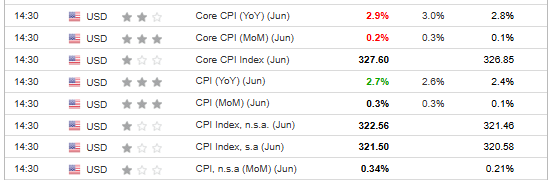

Yesterday’s US inflation data gave mixed signals. While the monthly core reading came in below expectations, the rose 2.7%—slightly above forecasts. This surprise was enough to strengthen the US dollar.

These readings do not give the Fed any reason to shift its current stance. This means the most hawkish scenario—no interest rate cuts this year—remains a real possibility. In such a policy environment, a sharp rise in silver prices toward historic highs appears very unlikely by year-end.

Silver Technical Analysis

The latest inflation data is now the main driver behind the market rebound, largely due to the strengthening of the US dollar. For silver, the first target for sellers is the area where the upward trend line meets the support level, around $37.50 per ounce.

If the $37.50 support breaks, it could pave the way for a further decline toward the next key support level near $35.50 per ounce, which has been tested multiple times. On the other hand, for buyers, the main target remains the round-number resistance at $40.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services.