Given the actions of Donald Trump’s administration recently, it wasn’t a surprise when they announced new tariffs on Japan and South Korea yesterday. The announcement said that a 25% tariff will be placed on Tokyo because talks haven’t made enough progress.

Right now, the currency exchange rate is stable within its usual range. The market will likely watch for signs of progress in the talks and any changes in the decision, as well as how the Bank of Japan will react. The bank’s leaders have often said they need more time to see how the trade war affects Japan’s economy, but if the tariffs remain, the Bank of Japan will have a challenging situation to handle.

Bank of Japan Rate Decision Nears

The Bank of Japan has been following a cautious approach this year. At its last meeting, it decided not to change interest rates, citing uncertainty about how potential tariffs might affect the Japanese economy. But this wait-and-see approach cannot continue forever, especially since inflation has stayed above the target for a long time. One clear sign of this is the sharp rise in rice prices, a key part of the Japanese diet.

If the 25% tariffs remain in place, it would be bad news for BOJ Governor Ueda and his team. On one hand, tariffs could push inflation even higher, making a stronger case for more interest rate hikes. On the other hand, these tariffs—especially on cars—could hurt Japan’s economic growth, and higher interest rates would make things worse.

This puts the BOJ in a tough spot where it will soon have to make some difficult decisions if the US sticks to its plan.

Fed Awaits More Data

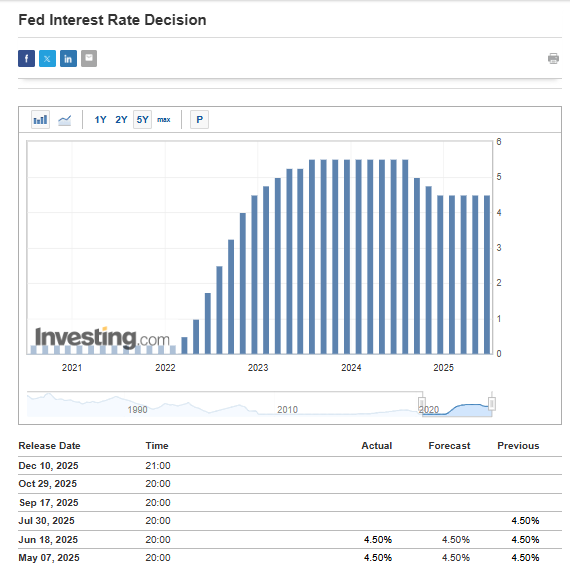

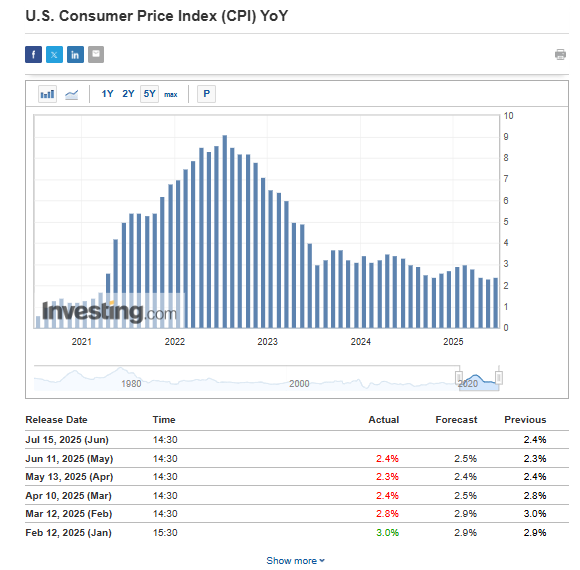

The US Federal Reserve is also in a wait-and-see mode, holding off on more cuts for now. Like the Bank of Japan, it is being cautious due to uncertainty around the impact of tariffs.

As of now, the next likely interest rate cut in the US is expected in September, with a 57% chance of a 25-basis-point reduction. The next key data release—focused on inflation—will come next week. Although recent inflation readings have been lower than expected, they are still above the Fed’s target.

USD/JPY Nears Range High—Breakout or Reversal Ahead?

Since early July, the US dollar has shown some short-term weakness. However, this has not changed the broader trend in the USD/JPY pair, which remains in a consolidation phase. If the dollar continues to weaken, the next target for buyers would be around 148 yen per dollar, near the upper end of the current range.

In the short term, traders watching for a possible upward move should keep an eye on support levels around 145 and 144 yen per dollar. If the price falls below the key support at 142 yen, that would suggest this upward scenario is no longer likely.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.