Even with the holiday period in Japan, there is quite a bit happening around the pair, as its recent upward momentum has slowed. In Japan, Prime Minister Shigeru Ishiba’s party lost in the upper house elections, which means he will likely need to form a coalition government. Depending on the fiscal direction of the new coalition, the Bank of Japan may need to adjust its monetary policy.

Meanwhile, trade talks between the US and Japan are still underway, with another round expected to begin this week. On the US side, one key issue is the Fed’s independence, as rumors about the possible removal of Fed Chair Jerome Powell continue to circulate — though the White House has repeatedly denied them.

Tariff Implementation Expected from 1 August

According to recent comments from the White House, including those by Scott Bessent, new US tariffs are set to begin on August 1 to push for better trade deals with individual countries. Japan remains under the threat of 25% tariffs. Another round of trade talks — the eighth so far — began in Washington yesterday, led by Japan’s Economic Recovery Minister Akazawa Ryosei. However, hopes for a breakthrough are low, with Ryosei warning that the negotiations will be difficult.

If there is no surprise or delay, the tariffs will take effect as planned. The Bank of Japan will likely have to respond. While the tariffs could raise — potentially supporting hikes — the BOJ will also need to consider the risk of slowing economic growth, which might argue against tightening policy.

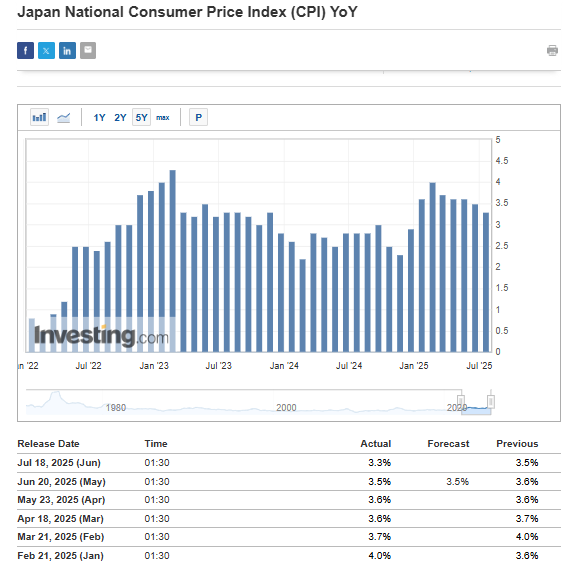

Japan’s Inflation Eases but Remains Above Target

The latest reading came in slightly below expectations at 3.3% year-on-year. This matches the underlying inflation figure, which also stands at 3.3%. In that case, it reflects a continued local disinflation trend that has been in place since February 2025.

This data trend is likely to support the hawkish camp, as it shows a clear slowdown in inflation. The next move will depend on the upcoming Bank of Japan meeting at the end of July.

USD/JPY Technical Analysis

After reaching the key resistance near 149 yen per dollar, USD/JPY lost momentum and entered a consolidation phase between 147 and 149. A breakout from this range will likely decide the next short-term direction.

If sellers push the price below 147 yen, it would confirm resistance holding and likely trigger a move toward 146. On the flip side, a break above 149 yen could open the path toward the next key resistance at 151.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services.