The pair is falling after recently hitting its highest level since September 2021. This drop looks like a typical correction. In the short term, the is gaining support because the is still taking a tough stance on inflation. The released last Wednesday showed that some officials prefer to keep interest rates unchanged until the end of the year, as inflation may stay above the target.

This week’s from both the US and the will be key to watch.

Outside of markets, President Trump said he would increase arms shipments to Ukraine and warned of new tariffs—up to 100%—if Russia does not agree to a deal.

Key Reasons Behind the Pause in Interest Rate Cuts

The Federal Reserve is holding back on cutting , unlike many other Western central banks. Inflation is slightly above the target, and there is a chance it could rise again in the second half of the year—especially with no resolution yet in key tariff disputes.

Despite pressure from President Donald Trump, who has suggested cutting rates to 1%, Fed Chair Jerome Powell and his team are staying firm. They remain calm because the is stable and the economy is still growing, with no signs of a recession.

Markets are still pricing in a possible 25 basis point rate cut, but with less than 60% certainty, it is far from a sure bet—especially since hawkish voices remain in control. Today’s CPI data will be important in showing whether a rate cut in September is actually likely.

Inflation Takes Center Stage This Week

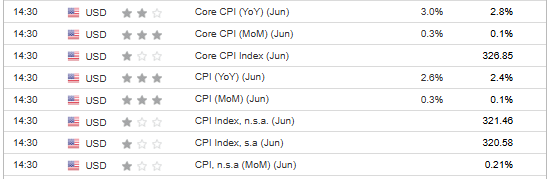

Mid-month is typically when inflation data is released for both the US and the Eurozone. Today, we will get key figures—specifically US consumer inflation. Both and are expected to show a year-on-year increase.

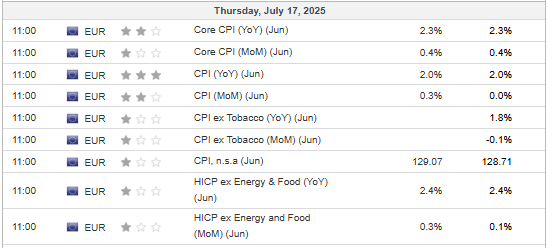

If the data meets or exceeds expectations, it will give the Fed more reason to hold off on cutting interest rates. After Wednesday’s slightly less important data in the US, attention will turn to Thursday’s CPI numbers from the Eurozone.

Unlike in the US, inflation in the Eurozone appears stable and within the target range. This gives the European Central Bank more room to continue cutting interest rates.

EUR/USD Continues to Trend Lower in Bearish Channel

The current correction is forming a downward price channel, which could still widen. However, further downside may be limited, as the price is nearing a strong support level around 1.1630.

If the 1.1630 support level is broken, sellers may push the price down further toward the next target at 1.1450. However, if this is just a correction, the main scenario still points to a rebound. A break above the upper boundary of the channel would confirm a return to upward movement.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services.